Table of Contents

Introduction

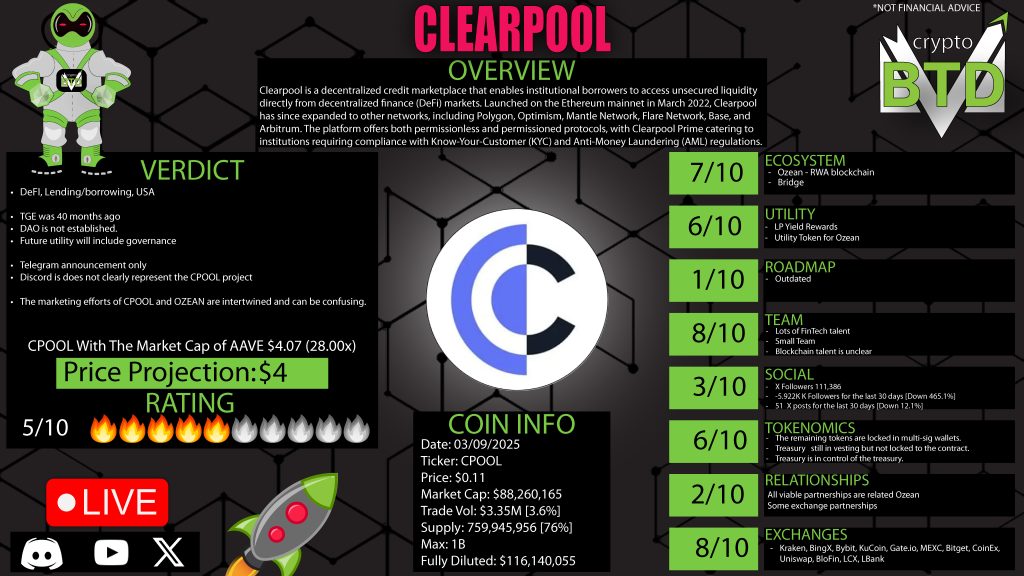

The cryptocurrency space continues to evolve with innovative projects seeking to redefine traditional finance. One such project is Clearpool, a decentralized credit marketplace that enables institutional borrowers to access unsecured liquidity. This deep dive will explore its fundamentals, tokenomics, partnerships, and overall value proposition to help you assess its overall value and potential in the crypto space.

What Is Clearpool?

Clearpool is a decentralized lending and borrowing protocol built on Ethereum. The protocol allows borrowers, particularly institutions, to obtain uncollateralized loans while lenders earn competitive interest rates. Unlike traditional finance, Clearpool leverages blockchain technology to provide transparent, secure, and permissionless lending markets.

Clearpool’s key features include:

- Institutional-grade DeFi lending

- Permissionless and permissioned pools

- Dynamic interest rates

- Multi-chain compatibility (Ethereum, Polygon, Optimism, Mantle)

- Staking and rewards for liquidity providers

Tokenomics of Clearpool (CPOOL)

Clearpool’s native token, CPOOL, serves multiple purposes within the ecosystem. These include:

- Governance: Although a DAO is not yet established, future governance is planned.

- Staking: Users can stake CPOOL to participate in interest rate voting.

- Rewards: Lenders and liquidity providers receive CPOOL as rewards.

- Utility in the Ozian Blockchain: Clearpool’s token will also serve as a key asset within the Ozian ecosystem, a real-world asset (RWA) blockchain initiative.

Clearpool Token Distribution:

- 76% of tokens are already in circulation

- Treasury tokens are unlocked but controlled by the team

- Liquidity is provided across major exchanges such as Bybit, KuCoin, and MEXC

While these tokenomics indicate a matured release schedule, concerns arise regarding centralized control over treasury funds, as governance mechanisms are not yet fully established.

The Ozian Confusion: Identity Crisis?

One major issue with Clearpool is the marketing confusion surrounding Ozian. Ozian is a separate blockchain initiative focused on real-world assets (RWA). While Clearpool plays a role in Ozian, the marketing materials often merge both projects, causing identity issues for investors. The official website and social media pages heavily promote Ozian rather than Clearpool, making it unclear what investors are actually supporting.

Team & Development

Clearpool boasts a strong leadership team with expertise in fintech, institutional finance, and blockchain technology:

- Robert Alcorn (CEO) – Experienced in financial technology and investments

- Jacob Sever (COO) – Business strategy and financial services expert

- Alessio Quaglini (Co-Founder) – Background in institutional finance and digital assets

Despite their strong financial backgrounds, the team lacks a highly visible blockchain engineering lead, raising concerns about the long-term sustainability of their technological infrastructure.

Strategic Partnerships & Backing

Clearpool is backed by several venture capital firms, providing it with credibility and liquidity. Some of the notable backers include:

- Sequoia Capital

- HashKey Capital

- Wintermute

However, it’s crucial to distinguish between financial backers and strategic partners. While Clearpool has strong investors, it lacks major institutional partnerships that could drive adoption at scale.

Roadmap & Future Outlook

One of the biggest concerns with Clearpool is the outdated roadmap. The last available update is from early 2023, and no clear timeline exists for future developments.

The lack of an updated roadmap makes it difficult for investors to gauge where the project is headed. Additionally, the absence of a governance DAO means that major decisions remain centralized, reducing transparency and decentralization.

Clearpool Strengths & Weaknesses

Strengths:

✅ Established lending and borrowing protocol

✅ Backed by strong VCs and institutional investors

✅ Expanding into real-world asset lending (RWA) via Ozian

✅ CPOOL token integrates into Ozian, increasing its utility

Weaknesses:

❌ Unclear branding and marketing (Clearpool vs. Ozian confusion)

❌ No active DAO governance yet

❌ Treasury funds controlled by the team

❌ No clear technological leadership visible

Final Thoughts

Clearpool has the potential to be a strong player in the DeFi lending space, particularly as institutional adoption of crypto grows. However, the confusion surrounding its identity, centralization concerns, and lack of a roadmap can create risks for investors.

Clearpool is a high-potential but high-risk project. If it successfully establishes a clearer brand identity and governance structure, it could become a top DeFi lending platform.

Conclusion

Decentralized lending is a growing sector in crypto, and Clearpool presents an intriguing opportunity. While the project has notable strengths, its marketing confusion, lack of decentralization, and roadmap transparency issues may hinder its long-term success. If you’re considering an investment, ensure you conduct thorough due diligence and stay updated on future developments.

What do you think about Clearpool? Is it a good investment or too risky? Let us know your thoughts in the comments below!

0 Comments