Table of Contents

Introduction

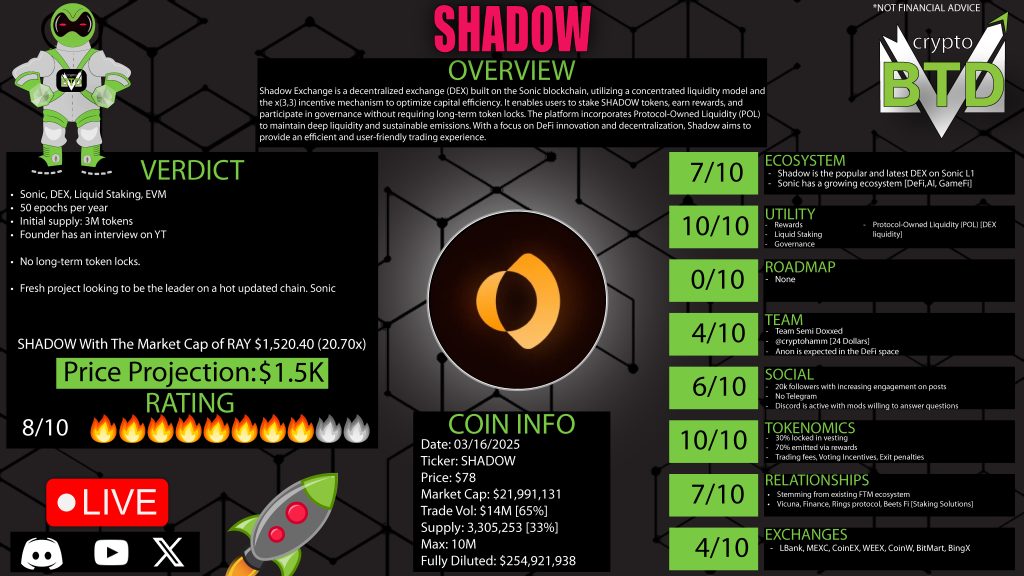

Cryptocurrency traders are always on the lookout for innovative decentralized exchanges (DEXs) that provide high efficiency, deep liquidity, and robust tokenomics. One of the most exciting developments in the crypto space is Shadow, a native concentrated liquidity exchange built specifically for Sonic, an upgraded Layer 1 blockchain. This article will dive deep into Shadow’s fundamentals, team, tokenomics, utility, and overall value proposition.

What is Shadow?

Shadow is a DEX designed exclusively for the Sonic network, a cutting-edge Layer 1 (L1) blockchain optimized for speed and efficiency. Just as every L1 network requires a DEX to facilitate decentralized finance (DeFi) activities, Sonic has Shadow as its primary trading hub.

Key features include:

- Concentrated Liquidity Pools — Allows liquidity providers to maximize returns by targeting active liquidity ranges.

- Dynamic Fee Structure — Optimized for market activity to improve efficiency.

- Protocol-Owned Liquidity (POL) — Helps maintain deep liquidity and ensures sustainable emissions.

- Liquid Staking with XShadow — Users can stake Shadow tokens to earn passive rewards and participate in governance without locking up their assets for extended periods.

- Voting and Governance — Token holders influence decision-making through a decentralized voting mechanism.

Shadow’s Role in the Sonic Ecosystem

Sonic is gaining momentum as a promising blockchain due to its focus on high-speed transactions, low fees, and EVM compatibility. As Sonic’s ecosystem grows with DeFi, gaming, and AI projects, Shadow stands to benefit significantly.

A thriving L1 network attracts more projects, users, and liquidity, all of which increase trading volume on its DEX. As the primary exchange, Shadow is well-positioned to capture market share and establish itself as the Uniswap or Raydium of Sonic.

Tokenomics of Shadow

Shadow has a well-balanced token distribution model that ensures sustainability and rewards active participants. Here’s a breakdown:

Shadow Supply Distribution

- Max Supply: 10 million Shadow tokens

- Circulating Supply (as of now): ~3.3 million tokens

- Emission Model: 70% of tokens are reserved for emissions and rewards, while 30% were distributed at launch

Emission & Vesting

- Shadow uses a slow, structured emission model to prevent inflation and ensure long-term sustainability.

- Tokens are released gradually through staking rewards, trading fees, and governance incentives.

- Early investors and team allocations are vested over time, reducing the risk of sudden dumps.

Exit Mechanism & Liquidity

- Unlike traditional DEX models, Shadow allows users to exit their staked positions at any time.

- Instant exits incur a 50% penalty, which funds liquidity incentives and protocol growth.

- A six-month vesting period allows users to exit at a 1:1 ratio, avoiding penalties.

How Shadow Generates Revenue

- Trading Fees — Collected from every swap on the platform.

- Exit Penalties — Fees from early exits provide additional revenue for liquidity providers.

- Governance Incentives — Users earn rewards for participating in governance decisions.

Governance & Community Participation

Governance is a key aspect of Shadow’s model. Holders of XShadow, the staked version of Shadow, can vote on:

- Liquidity Pair Incentives — Determines which pools receive more rewards.

- Protocol Upgrades — Helps shape the future of the DEX.

- Emission Rate Adjustments — Ensures sustainable rewards over time.

Unlike some DeFi projects, Shadow incentivizes active governance participation by redistributing protocol fees to voters. This mechanism encourages long-term engagement and aligns the interests of token holders with the platform’s growth.

Security & Transparency

Shadow prioritizes security and transparency, with multiple measures in place:

- Smart Contract Audits — Conducted to ensure the safety of user funds.

- Multisig Treasury Management — Prevents unauthorized access to protocol funds.

- On-Chain Transparency — All transactions, emissions, and rewards are trackable via SonicScan.

Current Market Position & Future Outlook

Market Cap & Exchange Listings

- Current Market Cap: ~$23 million (as of now)

- Exchanges: Listed on MEXC, LBank, CoinEx, BitMart, BingX, and other mid-sized platforms

- Potential for Growth: Additional listings on major exchanges could drive further adoption

Comparison to Other DEXs

Shadow’s closest comparison is Raydium on Solana. Raydium thrived due to Solana’s growth, and Shadow could follow a similar trajectory as Sonic expands. If Shadow reaches even half the market cap of Raydium, a 20x price increase is possible.

Potential Challenges

- Small Ecosystem — Sonic is still in its early stages, and adoption must grow for Shadow to reach its full potential.

- Lack of Roadmap — The team has not published an official roadmap, making it harder for investors to gauge long-term plans.

- Semi-Anon Team — The core developer, known as “24,” is public-facing but not fully doxxed.

Final Thoughts

Shadow presents an exciting investment opportunity due to its strong fundamentals, innovative liquidity model, and deep integration with Sonic. However, investors should be aware of the risks associated with early-stage projects and the uncertainties in the broader crypto market.

Pros:

✅ First-mover advantage as Sonic’s primary DEX

✅ Unique tokenomics with sustainable emissions

✅ Strong incentives for governance participation

✅ Security audits and transparent on-chain data

✅ Potential for 10–20x growth if Sonic gains traction

Cons:

❌ Relatively new ecosystem with limited adoption

❌ No clear roadmap from the development team

❌ Team is semi-anonymous, raising transparency concerns

❌ Higher token price may deter retail investors

Conclusion

Shadow is more than just a DEX — it’s a crucial part of the Sonic ecosystem, offering innovative liquidity solutions and strong incentives for active participation. As Sonic grows, Shadow’s trading volume, token value, and adoption are likely to rise as well.

However, as with any crypto investment, proper due diligence is essential. If you believe in Sonic’s potential and want exposure to a promising DeFi project, Shadow is worth considering.

What do you think about Shadow? Will it become the next major DEX? Let us know in the comments!

0 Comments