Table of Contents

Introduction

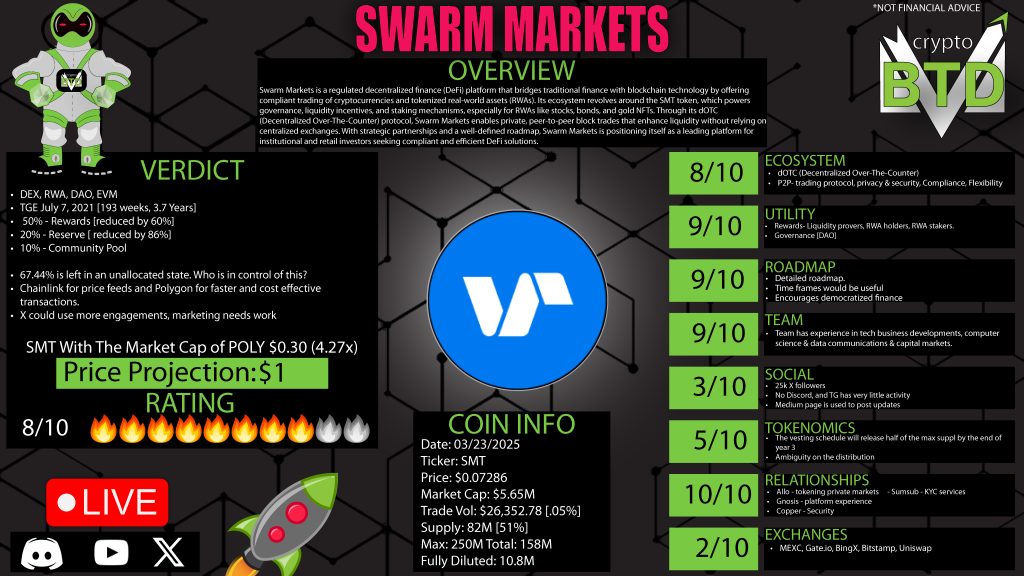

The world of decentralized finance (DeFi) is constantly evolving, and one project making headlines is Swarm Markets. This blockchain-based platform aims to revolutionize how real-world assets are traded and managed on-chain. In this article, we’ll dive into the fundamentals of Swarm Markets, including its team, tokenomics, utility, and overall value proposition. The goal? To see if Swarm Markets is a worthy addition to your crypto portfolio.

What Is Swarm Markets?

Swarm Markets is a decentralized exchange (DEX) and DeFi platform designed to bridge the gap between traditional finance (TradFi) and blockchain technology. Its primary goal is to enable users to trade real-world assets on-chain with 100% asset-backed compliance. This means you can trade stocks, commodities, and even gold on a decentralized, blockchain-based marketplace.

Swarm Markets’ key value proposition is its ability to tokenize real-world assets and make them available for trading on the blockchain. Through its use of smart contracts, Swarm Markets offers a compliant, transparent, and efficient trading experience that blends DeFi and traditional financial assets.

How Does Swarm Markets Work?

The platform offers decentralized over-the-counter (DOTC) trading, which enables institutions to execute large transactions without causing significant fluctuations in market prices. This is achieved through a peer-to-peer network that reduces slippage and eliminates counterparty risk. Users must complete KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, ensuring compliance with regulatory standards.

Swarm Markets is built on the Polygon network, a layer-2 scaling solution that offers fast transactions and low fees. This tech stack allows Swarm Markets to provide a seamless trading experience without the high gas fees associated with the Ethereum mainnet.

The Swarm Markets Token (SMT)

The SMT token is an ERC-20 token built on the Ethereum blockchain and compatible with EVM (Ethereum Virtual Machine). It serves multiple purposes within the Swarm Markets ecosystem, including governance, liquidity provision, and staking rewards.

Token Utility and Rewards

- Liquidity Providers: Users who provide liquidity to the DOTC protocol earn rewards proportionate to their contributions.

- Real-World Asset Holders: Holding tokenized assets on Swarm Markets earns users additional rewards, incentivizing long-term investment.

- Real-World Asset Stakers: Users who stake SMT against specific assets are entitled to staking rewards.

- Governance: SMT holders participate in governance decisions, making the platform more decentralized over time.

Swarm Markets Tokenomics

Swarm Markets originally had a total supply of 250 million SMT tokens. However, through governance votes and adjustments, this has been reduced to approximately 160 million SMT tokens. The token distribution is as follows:

- Rewards Pool: Reduced from 125 million tokens to approximately 49.4 million tokens.

- Reserve: Reduced from 50 million tokens to approximately 7 million tokens.

- Community Pool: Represents 10% of the total supply, which remains untouched.

However, a significant concern arises from the lack of clarity about the unallocated tokens, which could represent around 67.4% of the total supply. This ambiguity leaves potential investors uncertain about how these tokens will be utilized.

The Team Behind Swarm Markets

Swarm Markets boasts a small but talented team with expertise in business development, computer science, data communication, and blockchain technology. The team is fully doxxed, which adds to the project’s credibility, but their focus is spread across various projects, raising concerns about dedication and commitment to Swarm Markets.

Partnerships and Integrations

Swarm Markets has partnerships with several notable projects, including Chainlink, Polygon, Copper (for security), and Sumsub (for KYC/AML services). However, some partnerships are exaggerated as these services are available to the public without official collaborations.

Roadmap and Future Plans

Swarm Markets’ roadmap outlines plans to expand its ecosystem and enhance its technology. However, the lack of detail in their roadmap makes it challenging to understand what to expect in the coming months. More transparency and engagement with the community would be beneficial.

Market Position and Potential

With a market cap of approximately $6.4 million, Swarm Markets is still a small project. Compared to competitors like PolyMarkets, Swarm Markets has room for growth if it can effectively attract users and investors. The potential for SMT to reach $1 or beyond is not out of the question if the project gains traction and secures additional exchange listings.

Challenges and Concerns

The biggest challenge facing Swarm Markets is the ambiguity surrounding tokenomics. While the team has made efforts to improve governance and decentralization, clarity on how unallocated tokens will be used is critical.

Additionally, marketing and community engagement need improvement. Their social media presence is lackluster, and their Telegram community is inactive. Without proper engagement, building a strong user base will be difficult.

Pros and Cons

Pros:

✅ Innovative Technology: Bridges traditional finance and blockchain, enabling trading of real-world assets like stocks and commodities on-chain.

✅ Decentralized OTC Trading: Allows institutions to trade large amounts without affecting market prices.

✅ Compliance and Transparency: Built-in KYC and AML processes ensure regulatory compliance.

✅ Staking & Governance Rewards: Users can earn through liquidity provision, staking, and governance participation.

✅ Transparent Team: Fully doxxed, boosting credibility.

Cons:

❌ Unclear Tokenomics: Ambiguous details about unallocated tokens create uncertainty.

❌ Poor Community Engagement: Weak social media presence and low activity on Telegram.

❌ Vague Roadmap: Lacks specific milestones and future plans.

❌ Limited Listings: Low trading volume and limited exchange availability hinder growth.

Final Thoughts

Swarm Markets is an ambitious project aiming to bridge the gap between traditional and decentralized finance by tokenizing real-world assets. While the project’s technology and value proposition are compelling, unresolved issues with tokenomics and community engagement could be major hurdles.

If Swarm Markets can address these concerns, there’s a real possibility it could become a leader in the tokenization of real-world assets. However, until there’s more clarity, potential investors should approach with caution and do their due diligence.

Would you consider investing in Swarm Markets? Let me know in the comments below!

0 Comments