Table of Contents

The crypto space is evolving fast, and one narrative gaining massive traction is the rise of stablecoins, digital dollars that aim to bring the stability of fiat into the high-volatility world of decentralized finance (DeFi). Among the newest contenders is Ethena, a project designed to power digital dollars for the internet economy. But does it have what it takes to stand out in a competitive market already flooded with stablecoin experiments?

In this deep dive, we’ll explore the fundamentals of Ethena, including its team, tokenomics, stablecoin ecosystem, use cases, and governance. Whether you’re new to crypto or a seasoned DeFi user, this breakdown will help you understand Ethena’s role in reshaping internet money.

Let’s unpack the Ethena protocol and figure out why it’s gaining attention across both retail and institutional markets.

What Is Ethena?

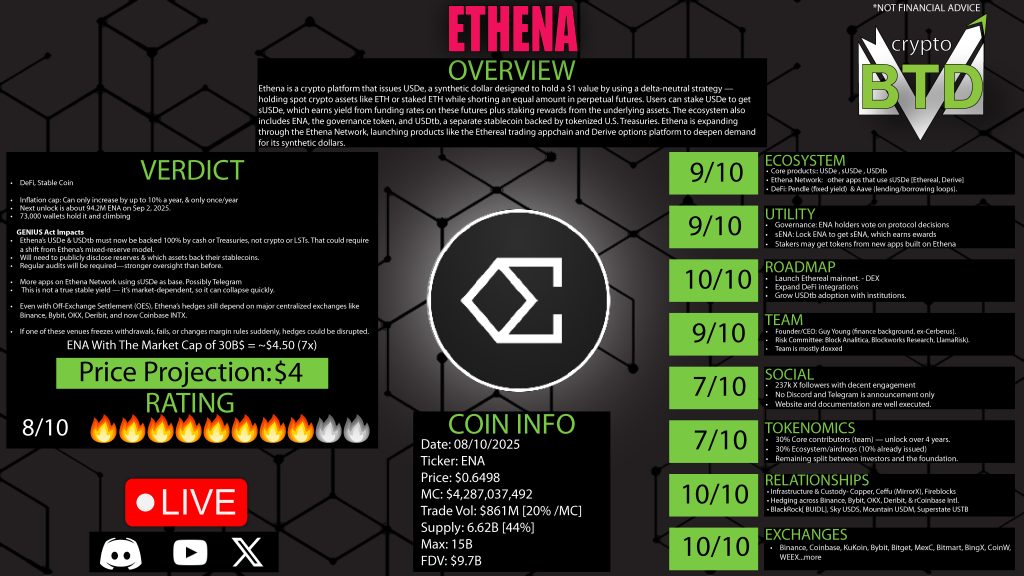

Ethena is a stablecoin ecosystem built around the idea of creating synthetic digital dollars backed by crypto assets. Instead of pegging directly to fiat currencies through centralized reserves like USDT or USDC, Ethena takes a different approach — algorithmic stability. Its flagship stablecoins include USDE, SUSD, and USDTB.

- USDE is a synthetic dollar maintained through delta-neutral hedging.

- SUSD is a staked version of USDE, allowing holders to earn yield.

- USDTB is backed by tokenized U.S. Treasury bills through BlackRock’s fund, bridging crypto and traditional finance.

Ethena’s ecosystem is supported by the ENA token, which acts as a governance asset. Holders of ENA can vote on proposals, participate in risk committees, and guide the protocol’s development.

The Core Vision: Stablecoins for the Internet Economy

Ethena’s mission is clear: create scalable, decentralized, and transparent digital dollars that don’t rely on traditional banking systems. In crypto, stablecoins serve as the backbone of DeFi — used for trading, lending, saving, and yield farming. Yet many of today’s stablecoins are still centralized and vulnerable to regulation, poor transparency, or limited scalability.

Ethena is betting that algorithmic stablecoins can provide a better solution, even though previous attempts (like Terra Luna’s UST) ended in disaster. The key difference? Ethena focuses on hedging risk using delta-neutral strategies and diversifying its reserve assets.

How Does Ethena Maintain Stability?

Ethena’s USDE doesn’t rely on dollars in a bank account. Instead, it uses a system called delta-neutral hedging, where it holds both long and short positions in major crypto assets like Bitcoin and Ethereum. This helps it stay “net neutral,” meaning the value of its reserve doesn’t move much even when markets do.

Here’s how it works:

- Reserve Assets: Bitcoin, Ethereum, and liquid staked tokens (LSTs).

- Short Positions: Futures and perpetual contracts to offset price movements.

- Liquid Stablecoins: USDC and USDT used to enhance efficiency.

- Oracles: Chainlink and Chaos Labs provide real-time reserve monitoring.

- Transparency: Weekly proof-of-reserves and regular attestations.

By combining real-time monitoring, hedging, and a diversified reserve model, Ethena aims to keep USDE pegged close to $1, even during turbulent market conditions.

The Ethena Ecosystem

Beyond its stablecoins, Ethena is building a broader ecosystem:

- Ethereal: A decentralized spot and perpetuals exchange.

- Derive: An on-chain options platform.

- Ethena Network: A growing list of DeFi applications that use SUSD as their base currency.

These applications aim to reward users with native tokens, offering incentives to adopt the Ethena stablecoins. It’s a win-win: developers get ecosystem support, and users earn rewards.

Also, partnerships with platforms like Pendle, Morpho, and Wintermute add strength to Ethena’s DeFi reach. On the institutional side, working with BlackRock for USDTB shows serious credibility.

ENA Token: Governance and Incentives

At the heart of the ecosystem is ENA, Ethena’s native token. Its main utility is governance, allowing holders to:

- Elect members of the Risk Committee.

- Vote on key proposals and upgrades.

- Influence tokenomics, emissions, and development direction.

ENA can also be staked to earn rewards through SENA, a locked version of ENA. This staking model is similar to other DeFi governance tokens where long-term holders are rewarded for supporting the network.

ENA is designed to reward participation, not just speculation. That said, the token does follow a vesting schedule, and a significant portion is allocated to core contributors and investors, with gradual unlocking over the next few years.

Ethena’s Use Cases and Real-World Value

Ethena’s synthetic stablecoins offer several real-world advantages:

- High Yield Savings: SUSD offers attractive APYs (up to 18% in 2024) through its hedging strategy and staked assets.

- Cross-Chain Liquidity: Stablecoins are chain-agnostic and integrate with major exchanges and DeFi platforms.

- Telegram Integration: Sending stablecoins via Telegram wallets could make peer-to-peer transfers seamless for over a billion users.

- Institutional Onboarding: USDTB, backed by tokenized T-bills, appeals to conservative investors and asset managers.

Ethena isn’t just offering another stablecoin. It’s pushing for an entire stablecoin economy, complete with incentives for builders, savings products for users, and compliance options for institutions.

Regulatory Landscape: The Genius Act

One potential challenge — and opportunity — for Ethena is the Genius Act, which mandates that all stablecoins be fully backed by dollars or treasury bills. This poses a problem for USDE, which is backed by crypto.

However, Ethena may adapt by:

- Continuing to use USDTB for institutional compliance.

- Providing full transparency and regular audits.

- Balancing crypto-backed models with fiat-backed options.

Instead of seeing this as a setback, Ethena could benefit from regulatory clarity. A hybrid model using both synthetic and fiat-backed stablecoins might offer the best of both worlds.

The Team Behind Ethena

Ethena Labs is led by Guy Young, a doxxed founder with experience in finance and crypto. The team includes developers, marketers, legal counsel, and engineers, though only around 13 members are publicly listed on LinkedIn.

The small but capable team is supported by an external risk committee featuring partners from Gauntlet, Blockworks, and other respected firms. The protocol also collaborates with data platforms, market makers, and DeFi giants, adding to its credibility.

Transparency and Communication

Ethena excels in transparency:

- Weekly proof-of-reserve updates.

- Real-time dashboards.

- Gitbook and blog documentation.

- Mirror.xyz blog with consistent updates.

However, one criticism is the lack of community engagement tools. There’s no public Telegram or Discord, which may be intentional given their institutional focus — but it limits grassroots involvement.

For a protocol that’s partially community-governed, this might be something to improve in the future.

Tokenomics: Strengths and Weaknesses

Tokenomics is where Ethena sees both opportunity and risk.

- Total Supply: ENA has a capped supply with a 10% annual inflation limit.

- Current Circulation: ~44% as of Q4 2025.

- Unlock Schedule: Gradual unlocks continue through 2028.

- Allocations:

- 30% Core Contributors.

- 25% Investors.

- 30% Ecosystem Incentives.

- 15% Foundation.

The good: gradual unlocks give the project time to grow organically.

The risk: future dilution could lead to sell pressure, especially in a bear market. This is common in early-stage protocols but something traders and holders should monitor.

Ethena Pros and Cons

Pros

- Innovative Stablecoin Model: Delta-neutral hedging introduces a novel way to maintain a peg.

- High Yield: Staking SUSD offers attractive APYs compared to traditional finance.

- Diverse Ecosystem: With new apps like Ethereal and Derive, Ethena is expanding fast.

- Institutional Partnerships: Collaboration with BlackRock and major exchanges boosts credibility.

- Transparent Governance: Token holders have real influence via voting and risk oversight.

- Regulatory Readiness: Adjustments to comply with future laws show foresight.

- Cross-Chain and Social Integration: Telegram wallet support opens huge new user bases.

Cons

- High Complexity: Hedging and synthetic dollars are difficult for newcomers to understand.

- Market Dependency: Yield and peg stability rely on favorable market conditions.

- Central Exchange Risk: Delta-neutral strategy depends on venues like Binance and Bybit.

- Token Unlock Risk: Ongoing vesting through 2028 could lead to sell pressure.

- Limited Community Access: No active Discord or Telegram for retail investors.

- Still Early: Ecosystem apps are not fully launched; adoption is ongoing.

Conclusion: A Bold Bet on the Future of Stablecoins

Ethena isn’t just trying to compete with the likes of USDT or USDC — it’s trying to redefine how we think about digital dollars. By blending crypto-native collateral, transparent governance, and real-world use cases, Ethena is positioning itself as a potential leader in stablecoin innovation.

Still, the road is not without obstacles. Market volatility, regulatory shifts, and token dilution remain key risks. But if Ethena can maintain its momentum and build out its ecosystem while staying compliant, it may become the decentralized solution the crypto economy has been waiting for.

As the stablecoin narrative continues to grow in 2026 and beyond, Ethena will be a name to watch.

0 Comments