Table of Contents

What Is Celestia?

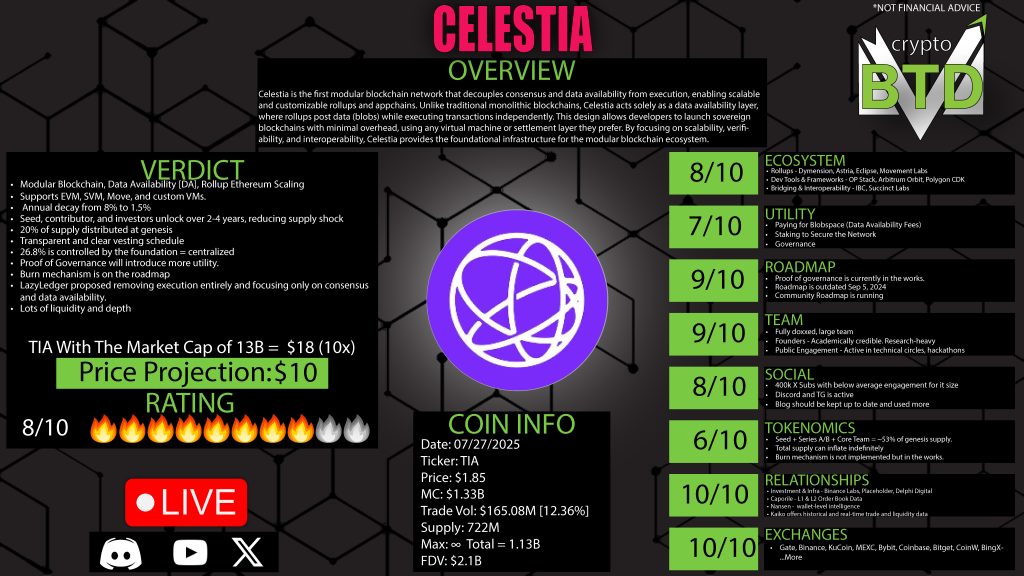

Celestia is the first modular blockchain network that separates consensus from execution. This is a major shift from the typical “monolithic” design used by most traditional blockchains like Bitcoin and Ethereum, where all the responsibilities — consensus, data availability, settlement, and execution — are bundled together.

In contrast, Celestia focuses on only two things: data availability and consensus. It doesn’t handle execution or settlement, which allows developers to pick and choose what parts of the stack they want to use and customize. This modular design makes it easier to scale blockchain networks and gives developers more flexibility to build tailored solutions.

Why Modularity Matters

Modular blockchains like Celestia separate the components of the blockchain stack. In a monolithic blockchain, everything is bundled: the chain must process transactions, agree on their order, and store the data — all in one place. This limits scalability and flexibility.

By splitting these layers apart, Celestia lets developers use the best tools for each layer. For example, a developer could use Celestia’s data availability layer, but use a different execution environment such as Ethereum Virtual Machine (EVM), Solana VM, or Move.

This approach allows projects to scale faster, reduce costs, and launch their own blockchains without needing a large validator set.

Celestia’s Key Use Case: Data Availability

One of Celestia’s biggest innovations is solving the problem of data availability.

Every blockchain must ensure that data related to transactions is publicly available. If this data is not available, then network participants can’t verify the state of the blockchain or validate transactions.

Celestia addresses this challenge with Data Availability Sampling (DAS). This allows light nodes (simple, low-resource devices) to randomly sample small parts of the data and still be confident that all the data is available. This makes Celestia highly scalable and secure, even with lots of users.

It also introduces the concept of “blobs” — large chunks of data that developers can pay to store on Celestia. This creates an entirely new value proposition: blockchains or apps can pay Celestia to store massive amounts of transaction data, making it a valuable infrastructure layer for the entire crypto ecosystem.

How Developers Can Use Celestia

One of Celestia’s core promises is making blockchain development more accessible. Developers can:

- Deploy their own sovereign blockchain or rollup.

- Use any virtual machine they like (EVM, SVM, Move).

- Rely on Celestia for consensus and data storage.

- Avoid needing to bootstrap a full validator network.

With Celestia “underneath,” you can mix and match the pieces you need, enabling fast deployment and complete flexibility.

Ecosystem and Use Cases

Although Celestia is still early in its growth phase, its ecosystem is steadily expanding. Some projects currently building or integrating with Celestia include:

- Dimension: A rollup platform built on Celestia that lets developers launch custom blockchains.

- Astria: A shared sequencer network for rollups that works with Celestia’s data layer.

- Eclipse: A modular rollup framework supporting multiple VMs and using Celestia for data availability.

- Movement Labs: Builds Move-based rollups that use Celestia to scale and store data.

- Rollup frameworks (OP Stack, Arbitrum Orbit, Polygon CDK): Toolkits for launching rollups that can integrate Celestia for cheaper data availability.

- Cosmos IBC: A protocol that allows Celestia to connect and share data with other Cosmos-based blockchains.

- Nansen and KO: Analytics platforms that can use Celestia’s on-chain data for wallet and trading insights.

Celestia is not just limited to Ethereum or Cosmos. Its chain-agnostic architecture allows it to support and scale applications across multiple Layer 1 and Layer 2 networks. This could make Celestia a foundational piece of multi-chain infrastructure.

Token Utility and TIA Tokenomics

Celestia’s native token, TIA, is used for:

- Paying for blob space (data storage fees)

- Staking to secure the network

- Participating in governance through the Celestia DAO

The initial total supply of TIA was 1 billion tokens at Genesis. However, the token does not have a capped maximum supply, which means it can inflate over time.

The inflation schedule starts at 8% in the first year and reduces by 10% annually until it reaches a long-term floor of 1.5%. This gradual reduction helps prevent runaway inflation but doesn’t fully eliminate dilution risk.

Currently, there is no burning mechanism to counter inflation. However, a community proposal for fee burning (similar to Ethereum’s EIP-1559) is in the works. This feature, if implemented, could significantly improve TIA’s long-term tokenomics by reducing the circulating supply over time.

Token Allocation and Vesting Concerns

One area where Celestia raises concerns is its token allocation.

More than 50% of the token supply is controlled by early contributors, core team members, and investors. This creates potential sell pressure during vesting unlocks, especially in bullish market conditions when early investors may want to take profits.

Token unlocks are scheduled over a four-year period, with a high concentration in the first two years. This makes it important for investors and ecosystem participants to be aware of dilution risks in the short term.

Additionally, 26.8% of tokens are controlled by the Celestia Foundation, raising questions about centralization. While this may be necessary to fund development and ecosystem growth, transparency and governance participation will be key to maintaining community trust.

The Team Behind Celestia

Celestia is backed by a team of academically strong, research-driven developers.

Notable team members include:

- Ismail Khoffi — Co-founder and CTO, with a background in mathematics and computer science.

- Mustafa Al-Bassam — Co-founder and CEO, formerly involved in Chainspace (acquired by Facebook).

- Nick White — COO and co-founder of Harmony Protocol, with a master’s degree from Stanford in electrical engineering.

The full team consists of over 40 professionals, including engineers, advisors, and legal counsel. The leadership is fully doxxed (publicly identified), which helps build trust and shows the team is committed to transparency.

Development and Roadmap

Celestia’s last official roadmap was published in September 2024, which is considered outdated by crypto standards. However, the project’s governance structure allows for community-driven updates, and proposals are regularly submitted through its DAO.

The biggest update expected is the Proof of Governance upgrade, which could unlock more token utility and introduce a formal burn mechanism. While development is moving slower compared to other projects, it’s clear that Celestia prioritizes quality and research-backed engineering over speed.

Some in the community have raised concerns about the slow pace of feature releases, but others argue that the academic and careful approach is necessary to ensure security and scalability.

Community and Social Presence

Celestia has over 400,000 followers on X (formerly Twitter), but engagement rates are below average for that number of followers. This could reflect the highly technical nature of the project or general market fatigue.

The team is more active in technical communities and hackathons, which aligns with its developer-first approach. Their blog, while well-written, has inconsistent updates and could benefit from more regular content to keep the community informed.

Their Discord and Telegram channels are active and offer helpful discussions around modular blockchain development.

Celestia’s Long-Term Potential

Celestia’s future depends heavily on a few key factors:

- Wider adoption of modular blockchain architecture

- Execution and delivery of planned upgrades (especially the burn mechanism)

- Ecosystem growth and real-world utility through partnerships

- Decentralized governance and clear communication with the community

If the blockchain industry continues to move toward scalable, customizable architectures, Celestia is well-positioned to lead that movement. Its chain-agnostic design and strong technical foundation make it an important infrastructure project for Web3.

But to realize its full potential, Celestia must improve its communication, accelerate ecosystem development, and introduce more incentives for token utility beyond staking and governance.

Pros and Cons of Celestia

Pros:

- First-mover advantage in modular blockchain design

- Chain-agnostic: supports EVM, SVM, Move, and more

- Powerful data availability layer with Data Availability Sampling

- High flexibility for developers to launch rollups or custom chains

- Strong and doxxed team with academic and industry experience

- Active participation in governance and hackathons

- Future upgrades planned, including fee burn mechanism

Cons:

- No max supply cap; high inflation risk without burning

- Over 50% of tokens allocated to early contributors, creating sell pressure

- Roadmap is outdated; limited communication on development progress

- Ecosystem is still young and lacks major native dApps

- Community engagement and blog updates are inconsistent

- Current utility is limited to staking, governance, and data fees

- Centralized control by the foundation over a large token share

Final Thoughts

Celestia is not your average blockchain. It’s changing the game by introducing a new architecture that can scale the entire crypto ecosystem. Its modular approach is smart, scalable, and built with developers in mind.

However, challenges like token distribution, lack of a burn mechanism, and slower communication need to be addressed for the project to achieve mass adoption. Still, its core value proposition is solid and has the potential to make Celestia a key player in the future of blockchain infrastructure.

0 Comments