Table of Contents

Introduction

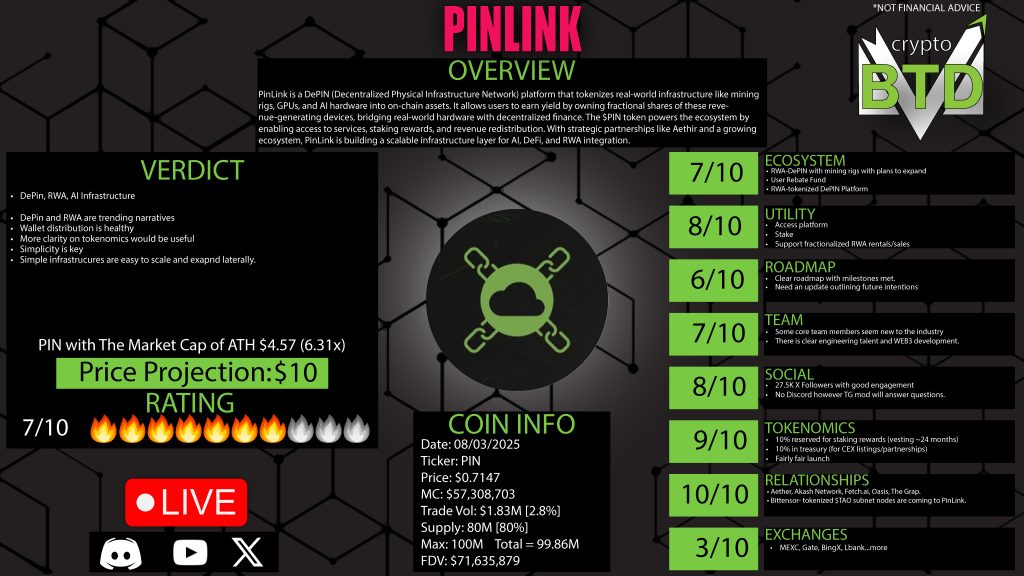

In the fast-moving world of cryptocurrency, staying ahead of emerging trends is key to identifying the next wave of innovation. One of the most exciting narratives currently gaining traction is the tokenization of real-world assets (RWAs) — bridging the gap between physical infrastructure and blockchain networks. PinLink, a project that combines this narrative with decentralized physical infrastructure (DePIN) and artificial intelligence (AI), is gaining attention for its unique approach to solving modern infrastructure challenges.

PinLink isn’t just about hardware on the blockchain. It’s building a decentralized marketplace for high-performance computing by tokenizing real-world computing resources like GPUs and enabling fractional ownership. This empowers AI developers with access to affordable compute power, and allows hardware owners to monetize idle resources. Let’s dive into what makes this project special.

What is PinLink?

PinLink is a decentralized platform built on Ethereum that enables users to tokenize and fractionalize physical computing assets like GPUs, servers, and soon other infrastructure components like CPUs, routers, or IoT devices. These tokenized assets are used within a DePIN (decentralized physical infrastructure) marketplace, where AI developers and other users can rent computing power using the platform’s native PIN token.

In other words, PinLink transforms idle, physical hardware into productive assets that generate passive income, while also reducing the cost of compute for AI projects and developers. It’s a win-win system built to optimize capital efficiency for both sides of the ecosystem.

First Impressions Matter

When visiting the PinLink website, the mission is clear: to decentralize access to real-world infrastructure. The homepage instantly communicates the platform’s focus on DePIN, AI, and RWA tokenization. This immediate clarity sets the tone for a well-executed platform. The visuals, layout, and user flow are professional and intuitive.

Sections on the website include a detailed roadmap, tokenomics, whitepaper access, team bios, platform mechanics, staking dashboard, and FAQs. This thorough and accessible information display indicates a team that values transparency and user experience.

Tokenizing Real-World Hardware

At the core of PinLink’s ecosystem is the concept of real-world asset tokenization. Asset owners register their physical hardware (like a GPU) with the platform. PinLink then issues an ERC-1155 token — a multi-token standard on Ethereum that allows a single contract to represent multiple token types — to represent that asset on-chain.

The owner can then sell fractional shares of that tokenized asset, which allows others to participate in the earnings generated by the hardware. This model makes enterprise-level compute infrastructure accessible to individual investors who couldn’t otherwise afford to buy an entire server or mining rig.

For example, a $2,000 GPU could be split into 100 shares, with each share earning a portion of the revenue generated from AI rentals, data mining, or decentralized cloud usage.

Pin AI Suite: Optimizing Resource Management

To manage the demand for compute resources, PinLink includes a software layer called Pin AI Suite. This suite helps optimize performance, efficiency, and allocation of the physical infrastructure. It uses machine learning algorithms to assess workloads, monitor usage, and dynamically route compute power to the most critical tasks.

This AI integration helps lower energy consumption, reduce costs, and maintain high availability for developers renting the infrastructure. It also ensures that asset owners get the most value from their hardware, as the system continuously optimizes for best use-case and revenue yield.

Fractionalized Ownership Made Simple

Fractionalized ownership isn’t just a tech feature; it’s a democratizing financial tool. It allows individuals to invest in high-cost assets, like GPUs and servers, without needing the capital to own the whole thing. Fractional ownership of tokenized infrastructure opens the door to passive income for a wide range of users.

The process is simple:

- Hardware is registered and validated.

- ERC-1155 token is minted to represent that asset.

- Token is split into fractional shares and made available on the marketplace.

- Buyers purchase shares and begin earning revenue proportionate to their ownership.

This is similar to owning a portion of a rental property but instead of collecting rent from tenants, users earn revenue from data processing, AI inference, or crypto mining workloads running on the hardware.

The Rebate Model for AI Developers

PinLink’s rebate model is a unique feature that supports AI developers by lowering the cost of compute. Here’s how it works:

- When tokenized assets are sold, 20% of the proceeds go into a yield-bearing rebate fund.

- This fund is invested into low-risk DeFi strategies (like staking on Aave, or LPing on Curve).

- The yield generated from these activities is returned to AI developers in the form of cost rebates.

This creates a cycle of reinvestment, where the ecosystem itself helps reduce friction for AI adoption by subsidizing hardware costs. The focus on “low-risk” strategies is important to avoid depleting the fund in volatile market conditions.

Built on Ethereum for Trust and Flexibility

PinLink’s infrastructure relies on Ethereum, the most battle-tested smart contract platform. Its use of ERC-20 and ERC-1155 standards ensures compatibility with major wallets, DEXs, and tooling across the Ethereum Virtual Machine (EVM) ecosystem.

This means the PIN token can be used seamlessly across existing DeFi platforms, staking protocols, and other interoperable dApps. It also enables deep liquidity and potential future integrations with layer-2 scaling solutions like Arbitrum or Optimism.

Staking and Passive Income

Staking is available directly on the PinLink platform. By staking PIN tokens, users earn a portion of the protocol’s revenue. These staking rewards are paid out from the platform’s earnings, not inflation, which is key for sustainability.

The staking dashboard shows over 20 million tokens currently staked, which represents a large portion of the total supply. This helps reduce circulating supply and indicates strong long-term interest from holders.

Documentation and User Resources

PinLink’s GitBook is well-structured and contains in-depth documentation on how the platform works, including:

- Asset onboarding

- Token minting process

- Revenue distribution models

- Staking mechanics

- FAQs and troubleshooting guides

The whitepaper further breaks down their technical infrastructure, economic model, and long-term vision. However, the roadmap section is lacking in forward-looking detail. It only outlines plans until early 2025, with no quarterly milestones or goals. Updating this would greatly improve transparency.

The Team Behind the Project

The core team is fully doxxed and includes experts in infrastructure engineering, blockchain development, and business operations. Notable team members include:

- Lucas Sztandera — Chief Architect

- PhD in Computational and Applied Mathematics

- Former VP of Engineering at 5chain

- Experienced in Web3 infrastructure and security

- Tal Hever-Chybowski — Co-Founder and Operations Lead

- Background in operations and luxury asset management

- Previously involved in premium furniture and lifestyle brands

- Focused on team coordination and logistics

While some team members are newer to crypto, they are experienced in building businesses and scaling tech operations. Lucas appears to be the core technical mind behind the project.

Active and Engaged Community

PinLink’s Twitter account has around 28,000 followers, with posts regularly receiving hundreds of likes and shares. This high engagement, relative to size, is a positive indicator of an active community.

The Telegram group is responsive and features helpful moderators, but the project lacks a Discord server. Discord would allow for better community segmentation (by language, topic, or product interest), event hosting, and documentation distribution. Launching a Discord could significantly strengthen community engagement.

Strategic Partnerships

One of the most promising aspects of PinLink is its early ecosystem collaborations. The platform is integrated or building with:

- TAO (Bittensor): a decentralized machine learning network

- Aether: another deepin protocol

- Akash: decentralized cloud compute provider

- Oasis Network and Fetch.ai: known for AI and data privacy infrastructure

These connections help validate PinLink as a serious infrastructure player and offer pathways for future interoperability.

Tokenomics Overview

The PIN token has a max supply of 100 million, with about 80 million in current circulation. The distribution was relatively fair:

- 80% to the community via Uniswap liquidity and market supply

- 10% for staking rewards (vested over 24 months)

- 10% to the treasury

There is also a 5% buy/sell tax on PIN transactions, which funds operational costs and rewards stakers. While taxes are sometimes controversial, in this case they support ecosystem growth and aren’t excessive.

A potential concern is the unclear status of token burns. The total supply suggests some burning may have occurred, but documentation doesn’t clearly explain this. A dedicated section explaining the burn mechanism would improve clarity for retail investors.

Real-World Application: Hashlink

Hashlink is one of the most exciting product releases from PinLink. It allows users to buy fractional shares of enterprise-grade Bitcoin mining operations using USDC and earn rewards in wrapped BTC (WBTC).

This offering bridges RWA tokenization with BTC yield generation and provides exposure to mining profits without owning or maintaining hardware. It also aligns perfectly with PinLink’s mission of fractional access to real-world infrastructure.

Expanding Ecosystem and Future Utility

PinLink is starting with GPU tokenization, but the roadmap hints at expansion into:

- CPU assets

- IoT devices

- Wireless routers and nodes

- Edge computing infrastructure

Each of these categories can be tokenized and added to the marketplace, increasing the total addressable market (TAM) and utility of the PIN token. Diversifying hardware types also makes the platform more resilient to changing market demands.

Conclusion

PinLink is creating a scalable infrastructure platform for tokenizing and monetizing physical computing resources. It combines DePIN, AI, and RWA tokenization to offer a decentralized, open marketplace for high-performance computing. Whether you’re an investor, a developer, or a hardware owner, PinLink provides a gateway into an increasingly vital segment of the Web3 economy.

While the team is young and there are areas for improvement (like roadmap updates and community tooling), the product is well-designed, the documentation is strong, and the real-world use case is clear.

Pros and Cons

Pros:

- Combines DePIN, AI, and RWA into one platform

- Tokenizes real-world compute assets with ERC-1155

- Enables fractional ownership and passive income

- Supports AI devs with yield-based rebates

- Strong documentation and clean UI/UX

- Fully doxxed team with solid credentials

- Active community with high engagement

- Hashlink mining product adds utility

- Ethereum-based for trust and interoperability

- Staking and governance features built in

Cons:

- Roadmap needs updating beyond early 2025

- Young team with limited Web3 experience

- No Discord server yet for deeper community management

- Yield-bearing rebate fund carries potential risk

- Token burn details are unclear

- Limited centralized exchange listings

- 5% transaction tax may deter some traders

Final Thoughts

PinLink offers a compelling value proposition with clear use cases and strong alignment to current market narratives. It’s not just riding hype but providing real infrastructure for the future of AI and decentralized cloud services.

While still in early stages, the foundation is solid. If the team continues executing and expanding partnerships, PinLink could become a key player in the DePIN space. With a growing ecosystem, functional staking, and working products like Hashlink, the project is worth watching closely as it evolves.

0 Comments