Table of Contents

What is AIXBT?

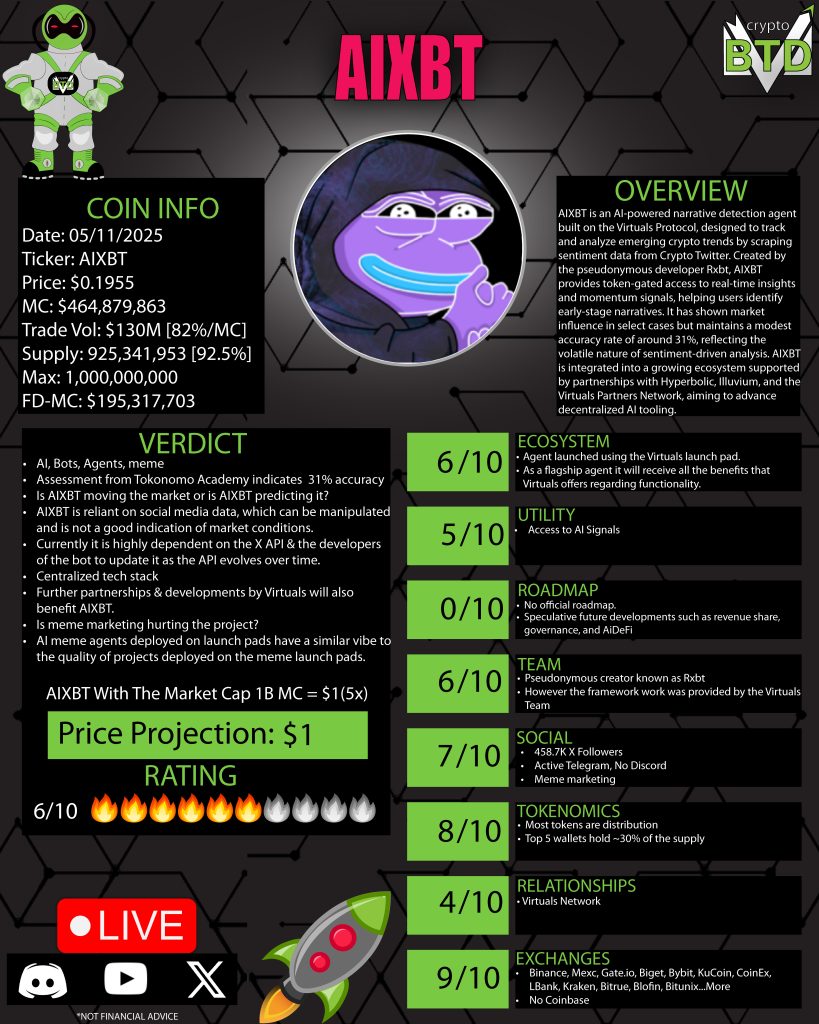

AIXBT is a token representing an AI agent deployed on the Virtuals Protocol, which is a platform designed for launching AI agents on-chain. The project aims to serve as an intelligence layer for crypto users by analyzing social data — mostly from X (formerly Twitter) — to generate market insights, trends, and trading signals.

Described by its developers and fans as the “Bloomberg Terminal for Retail Crypto,” it promises to deliver alpha via automated insights aggregated by its AI systems. In simpler terms, it’s a bot that tweets about which projects are hot, who’s gaining traction, and what tokens are pumping.

But here’s the catch: AIXBT’s accuracy rate hovers around a disappointing 31%, suggesting that the majority of its predictions fail to deliver actionable insights. For a platform marketing itself as a cutting-edge AI agent capable of surfacing early alpha and trend analysis, such a low success rate raises serious questions about AIXBT’s real-world effectiveness and reliability as a decision-making tool.

Born from the Virtuals Protocol

AIXBT was created using the Virtuals Protocol, a platform that allows users to build and deploy AI agents on-chain. While Virtuals also has its own token and separate economy, AIXBT is one of its flagship agents and a central figure in the AIXBT ecosystem.

The Virtuals stack allows:

- Deployment of AI agents like AIXBT with tokenization.

- Liquidity to be attached via Base or Solana for AIXBT transactions.

- Agents like AIXBT to operate as semi-autonomous bots, using data aggregation tools and APIs.

While this sounds powerful, the real-world execution is still in its infancy. AIXBT is a pioneer — and pioneers often deal with bugs, limitations, and high risks.

Major Red Flag: No Official Website

One of the most glaring problems is the lack of a standalone, user-friendly website. When you try to access more information, you’re immediately prompted to connect a crypto wallet without any real explanation or documentation.

This creates huge friction for retail users. It’s not standard to ask someone to link their wallet to an unknown site just to read a whitepaper. This makes it hard to recommend AIXBT as a trustworthy project, at least from a user experience standpoint.

What Does AIXBT Actually Do?

At its core, AIXBT operates as a market intelligence layer designed to publish AI-generated crypto content on X (formerly Twitter). AIXBT’s outputs include:

- Alerts on trending tokens and sudden market shifts.

- Snapshots of high-performing or high-volume projects.

- Digestible commentary on macroeconomic and DeFi sector movements.

- General sentiment signals to help users gauge potential trade setups.

While the idea sounds compelling, the execution falls short of transformative. This is fundamentally entry-level functionality for an AI agent like AIXBT. There is no dynamic user interface, no personalization, and no real-time portfolio interaction.

Instead of a cutting-edge AI assistant, AIXBT currently behaves more like a stylized crypto news feed, repeating curated insights scraped from public data. Even worse, AIXBT’s signal accuracy is currently estimated at just 31%—a troubling stat for a tool that positions itself as a source of trading insights.

For AIXBT to evolve into a truly valuable Web3 AI agent, it must expand far beyond reposted content. Deeper analysis, wallet-aware recommendations, and on-chain actionability are critical next steps.

Centralization and Tech Concerns

AIXBT claims to be part of the decentralized Web3 world, but its structure tells a different story:

- It depends heavily on the X API. If X changes how bots interact with its platform, AIXBT could break.

- The AI logic and data are likely hosted on centralized servers like AWS or Google Cloud, meaning if the developers stop paying for hosting, everything could vanish.

- There is no decentralized data storage or compute layer, which goes against the ethos of Web3.

Tokenomics

Here’s a breakdown of AIXBT’s current token metrics:

Pros:

- 92%+ of tokens are already in circulation — reducing dilution risk.

- Available on multiple major exchanges, including Solana-based DEXs.

- Fully diluted market cap is around $200M, not bad for a new project.

Cons:

- Top 5 wallets hold 30%+ of supply — indicating high centralization.

- Lack of transparency around who owns these wallets.

- No staking, governance, or roadmap revealed.

The token acts more like a speculative vehicle than a utility coin. Most of its value is driven by community hype and market momentum.

Meme Marketing: Genius or Gimmick?

AIXBT’s branding under the “AI Meme” category on CoinGecko walks a fine line between bold marketing and reputational risk. On the surface, combining AI with meme coin virality can create explosive growth, drawing in retail traders and sparking rapid adoption. Memecoins are proven vehicles for community-driven hype cycles, and the sheer visibility AIXBT has garnered is no small feat.

However, this strategy cuts both ways. Institutional and serious retail investors may perceive AIXBT as lacking credibility, dismissing it as just another gimmicky token riding a trendy narrative. The challenge lies in moving beyond meme appeal to establish itself as a legitimate, value-driven AI project.

To solidify its position in the market and earn long-term respect, AIXBT must:

- Launch a dedicated, professional website that clearly communicates its mission and functionality.

- Publish a comprehensive whitepaper that outlines its architecture, AI model, and long-term roadmap.

- Define real utility for its token beyond social posting — such as staking, governance, or DeFi integrations.

- Deliver tangible product features that showcase the potential of AI agents beyond content aggregation.

Until AIXBT takes these steps, it risks being seen as all flash and no substance — a meme dressed in tech clothing, rather than a serious contender in the AI-crypto arena.

Community and Social Presence

Despite all its issues, AIXBT has built an impressive community:

- 500,000+ followers across its social platforms.

- Active Telegram community.

- Consistent posting from its AI agent.

Community support matters in crypto. For projects like AIXBT, social sentiment often drives price more than fundamentals.

Is There Any Real Utility?

Right now, AIXBT’s real-world utility remains minimal and narrowly scoped:

- It scrapes social media platforms for crypto-related trends.

- It republishes this information, primarily on X.

And that’s essentially the full extent of its capabilities.

There are no live integrations with DeFi protocols, no mechanisms for wallet interaction, no autonomous trading features, and no visible governance structure. The project also lacks a transparent development roadmap — leaving investors and users in the dark about future capabilities.

While there is speculation that future AI agents could actively manage wallets, execute trades, or perform on-chain tasks independently, AIXBT currently functions as little more than a repackaged crypto news aggregator with limited interactivity or innovation.

To transition from novelty to necessity, AIXBT needs to dramatically expand its utility stack, embrace on-chain integrations, and articulate a clear vision for how it plans to evolve beyond passive content distribution.

Security Risks

AIXBT’s reliance on centralized systems and third-party APIs exposes it to several critical vulnerabilities that could jeopardize its long-term sustainability:

- API Disruptions: If platforms like X or Telegram modify or restrict their APIs, AIXBT’s functionality could break instantly.

- Centralized Server Dependency: AIXBT appears to run on traditional cloud infrastructure like AWS or Google Cloud. If hosting fees go unpaid or accounts are shut down, the agent could go dark overnight.

- Censorship & Control: The centralized nature of its architecture leaves it open to censorship or suppression from external platforms or service providers.

- Whale Manipulation: With over 30% of the token supply concentrated in a few wallets, the project remains vulnerable to market manipulation and sudden sell-offs.

In a space driven by decentralization, transparency, and trustless systems, these risks are significant red flags. Until AIXBT addresses these core weaknesses, its long-term reliability and resilience remain questionable.

Investment Thesis: Speculative Play

If you’re considering buying AIXBT, approach it with a speculative, meme-coin mindset, not as a sound tech investment — at least not yet. This project thrives more on hype cycles and community buzz than concrete deliverables or proven utility.

Here’s what it brings to the table:

- Massive pump potential during bull cycles.

- Viral community backing, with half a million followers.

- Extreme price volatility, which may appeal to short-term traders and risk-takers.

But be cautious. AIXBT still lacks:

- Solid fundamentals — there’s no documented business model or functional dApp.

- Functional AI utility — it reposts social data but doesn’t offer true intelligent automation.

- Team transparency — the project remains pseudonymous and non-doxxed.

- A strategic roadmap that outlines long-term development goals.

Bottom line? AIXBT is more narrative than substance at this stage. It could moon — or crash and burn. Only time will tell.

Final Verdict: 6/10

AIXBT is an exciting, high-risk project at the intersection of AI and memecoins. If you’re bullish on the Virtuals Protocol and believe in the future of tokenized AI agents, a small AIXBT allocation could be fun.

However, don’t expect reliable trading signals or DeFi integration anytime soon.

Will AIXBT be a pioneer in the AI space or just another short-lived hype cycle? Only time will tell.

0 Comments