Table of Contents

Why Bitcoin Still Matters

Bitcoin is not just the first cryptocurrency. It’s the blueprint for the decentralized financial future. In this deep dive, we’ll break down Bitcoin from the basics to the advanced—including its technology, tokenomics, mining ecosystem, criticisms, and real-world value. Whether you’re a beginner or a seasoned investor, this article explains why Bitcoin remains the heavyweight champion of crypto.

As governments print more money and inflation continues to erode fiat currencies, Bitcoin stands tall as a digital alternative that cannot be manipulated. Its decentralized nature, predictable monetary policy, and borderless utility make it more than a speculative asset—it’s an idea whose time has come.

What Is Bitcoin?

At its core, Bitcoin is a Layer 1 blockchain protocol and peer-to-peer payment system that operates without a central authority. Created in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin allows users to send digital money across the internet without needing banks. As a foundational Layer 1 network, it provides the base security, consensus, and data availability for all activity conducted on its chain. Instead of relying on a third-party intermediary, Bitcoin uses a decentralized ledger called the blockchain to record transactions, ensuring transparency and immutability.

Unlike traditional currencies, Bitcoin is limited. Only 21 million coins will ever exist. This scarcity has made it a digital version of gold in the eyes of many and a powerful hedge against inflation. It is borderless, permissionless, and immune to government interference—a radical alternative to fiat money.

Bitcoin’s trustless design eliminates the need for intermediaries. Users can transact directly, with no risk of censorship or confiscation. In many parts of the world, this feature alone makes Bitcoin revolutionary.

Bitcoin: More Than Just a Currency

Bitcoin isn’t just “internet money.” It is a software solution that offers a new form of digital ownership and economic freedom. Here are the core features:

- Decentralized: No central bank or government controls it.

- Open-source: Anyone can inspect, fork, or contribute to the code.

- Censorship-resistant: No one can stop a transaction from going through.

- Borderless: Bitcoin can be sent anywhere in the world instantly.

- Transparent: Every transaction is recorded on a public blockchain.

- Finite supply: Only 21 million coins will ever be created, making it inherently deflationary.

These traits make Bitcoin an ideal candidate for a global financial revolution. It removes middlemen and empowers individuals to control their own wealth, making it a fundamentally new financial tool.

In addition, Bitcoin is programmable money. Although not a smart contract platform like Ethereum, innovations like Taproot and the Lightning Network bring limited programmability and scalability to Bitcoin’s protocol.

How Bitcoin Works: The Basics

Bitcoin works through three main components:

- Wallets: Software that holds your Bitcoin and allows you to send/receive it. There are hot wallets (connected to the internet) and cold wallets (offline for extra security).

- Blockchain: A public, tamper-proof ledger of every transaction ever made. Each new transaction is grouped into a block.

- Miners: Specialized computers that solve complex cryptographic problems to validate transactions and add them to the blockchain. They are rewarded with newly minted Bitcoin and transaction fees.

Every transaction is broadcasted to the network, validated by miners, and added to a block. Each block is then linked to the previous one, creating a chain—hence the term “blockchain.”

Bitcoin’s use of Proof-of-Work (PoW) not only secures the network but also aligns economic incentives with network integrity. The longer the network exists, the harder it becomes to attack or manipulate.

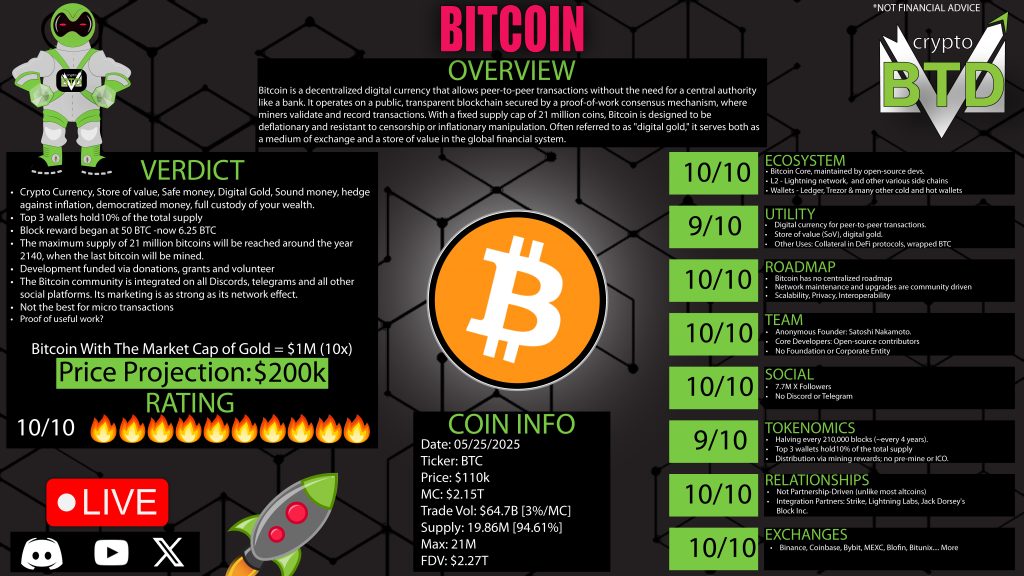

Tokenomics: Bitcoin’s Economic Blueprint

Bitcoin’s economic model is elegant and mathematically sound:

- Max Supply: 21 million BTC

- Circulating Supply (2025): ~19.8 million BTC (~94% of max)

- Distribution Mechanism: Mining rewards

A defining feature of Bitcoin is its halving event. Every four years, the reward miners receive for securing the network is cut in half. This is Bitcoin’s built-in deflationary mechanism. It slows the rate at which new BTC enters circulation and creates a “supply shock” that often leads to increased prices.

Historical Halvings:

- 2012: Reward dropped from 50 to 25 BTC

- 2016: Dropped to 12.5 BTC

- 2020: Dropped to 6.25 BTC

- 2024: Dropped to 3.125 BTC

The next halving will occur in 2028, continuing this pattern until the year 2140, when all 21 million BTC will be mined.

This predictable monetary policy makes Bitcoin the most transparent and programmatic monetary system ever created.

Bitcoin also supports fractional ownership, making it accessible to all. Each Bitcoin is divisible into 100 million units called satoshis, enabling micro-level ownership and use.

Who Owns Bitcoin?

Despite its decentralization, ownership of Bitcoin is not perfectly distributed. The top 3 wallets hold approximately 10% of all Bitcoin:

- Satoshi Nakamoto: ~1 million BTC (untouched since 2009)

- Binance Exchange: ~633,000 BTC (for liquidity and custody)

- MicroStrategy (Michael Saylor): ~423,000 BTC (corporate treasury)

Other major holders include the U.S. government, which holds over 200,000 BTC from asset seizures, and Grayscale, which offers institutional access to Bitcoin via trusts.

This distribution highlights both Bitcoin’s adoption and a potential centralization issue if too few entities gain control.

Yet, Bitcoin remains globally accessible. Anyone with a phone and internet connection can download a wallet, buy a fraction of BTC, and become part of this digital revolution.

Mining: Powering the Network

Miners secure the Bitcoin network by performing energy-intensive calculations to validate transactions. This process is called Proof-of-Work (PoW).

- Miners compete to solve mathematical puzzles

- Winners add new blocks to the blockchain and earn BTC rewards

- Energy-intensive but highly secure

Critics argue that mining consumes too much energy. However, recent studies show that over 50% of Bitcoin mining now uses renewable energy. Furthermore, PoW ensures unparalleled security and decentralization.

As mining rewards shrink, transaction fees will eventually become the primary incentive for miners.

Mining difficulty adjusts every 2,016 blocks (~2 weeks), ensuring block times remain around 10 minutes regardless of network size. This makes the Bitcoin network self-regulating and stable.

Nodes vs Miners: What’s the Difference?

- Nodes: Validate transactions, enforce consensus rules, and keep copies of the blockchain. They do not earn BTC.

- Miners: Validate and confirm transactions through mining. They earn BTC rewards and fees.

Together, they form a decentralized consensus system that maintains Bitcoin’s integrity.

There are over 15,000 publicly accessible nodes in 2025, with countless more running privately, ensuring that no single entity can manipulate the network.

Real-World Use Cases

Bitcoin’s most valuable use case is its role as a store of value. However, it is also used for:

- Borderless remittances with minimal fees

- Digital collateral in DeFi protocols

- Wealth preservation in countries with unstable currencies

- Micropayments (via Layer 2s like the Lightning Network)

Bitcoin is being adopted globally, not just by tech enthusiasts but by governments, hedge funds, and corporations. From El Salvador to Fortune 500 companies, Bitcoin is now a viable financial instrument.

Criticisms & Counterpoints

| Criticism | Counterpoint |

|---|---|

| High energy usage | Over 50% of mining now uses renewables |

| Mining centralization | Still more decentralized than banks or governments |

| High fees | Lightning Network solves this problem |

| Volatility | Lessening over time as the market matures |

| Anonymous founder | Decentralization is the point |

No technology is perfect. Bitcoin has flaws, but they are often overblown or actively being solved.

Layer 2 (L2) Solutions: Scaling Bitcoin

Bitcoin isn’t fast or cheap enough for daily purchases. That’s where L2 solutions like Lightning Network come in:

- Instant payments

- Low fees

- Privacy enhancements

Other innovations include Liquid Network, Stacks, and native L2 solutions that aim to bring DeFi and smart contracts to Bitcoin without compromising its base layer.

Who Controls Bitcoin?

Nobody.

Bitcoin has no CEO, board, or governing entity. Code changes must be proposed by developers and then voluntarily adopted by nodes and miners. This is decentralization in action.

Bitcoin operates like a DAO: it’s self-sustaining, community-driven, and censorship-resistant. This makes it highly resilient to political and corporate interference.

Legal Recognition and Regulation

Bitcoin is legal in most countries and classified as a commodity in the U.S. The IRS and other agencies treat it as property for tax purposes.

Governments that once feared Bitcoin are now embracing or regulating it. Institutional clarity is growing, with ETFs and crypto-friendly banking initiatives increasing worldwide.

Market Performance

- Current Market Cap (2025): $2.1 Trillion

- Rank: #1 in cryptocurrency

- All-time high: ~$110,000

- Historical ROI: Over 1,000,000% since 2009

Bitcoin has outperformed every other asset class in the past decade. Even during bear markets, long-term holders have been rewarded.

Compared to gold (~$13 trillion), Bitcoin still has significant room to grow. A 6x from here would give it parity.

Where Is Bitcoin Headed?

The future is bright:

- Scarcity increases with each halving

- Layer 2s unlock new use cases

- Institutional adoption is rising

- Retail interest remains strong

As Bitcoin matures, volatility will likely decrease. Expect more regulatory clarity, new infrastructure, and integrations across the global financial system.

Final Verdict: Is Bitcoin Still Worth It in 2025?

Absolutely.

Bitcoin is:

- The most secure blockchain in the world

- The most decentralized crypto asset

- The most trusted digital store of value

Its fundamentals have never been stronger. While not ideal for every use case, Bitcoin does one thing better than anything else: give people control of their money.

From Venezuela to Wall Street, Bitcoin is changing how we think about currency, wealth, and freedom.

Should you own Bitcoin? That’s up to you. But in a world of central bank instability, economic uncertainty, and digital surveillance, Bitcoin represents hope.

What are your thoughts on Bitcoin’s future? Will it surpass gold or lose its crown? Drop your predictions in the comments!

0 Comments