Table of Contents

In the fast-moving world of crypto, very few projects manage to stand out and spark real conversation. Hyperliquid is one of those rare players. Branded as the “blockchain to house all finance,” it positions itself as a powerful new Layer 1 (L1) blockchain that aims to bring performance, innovation, and decentralization under one roof.

In this blog post, we’ll break down what Hyperliquid is, how it works, and why it’s gaining so much attention from developers, DeFi enthusiasts, and the broader crypto community.

What Is Hyperliquid?

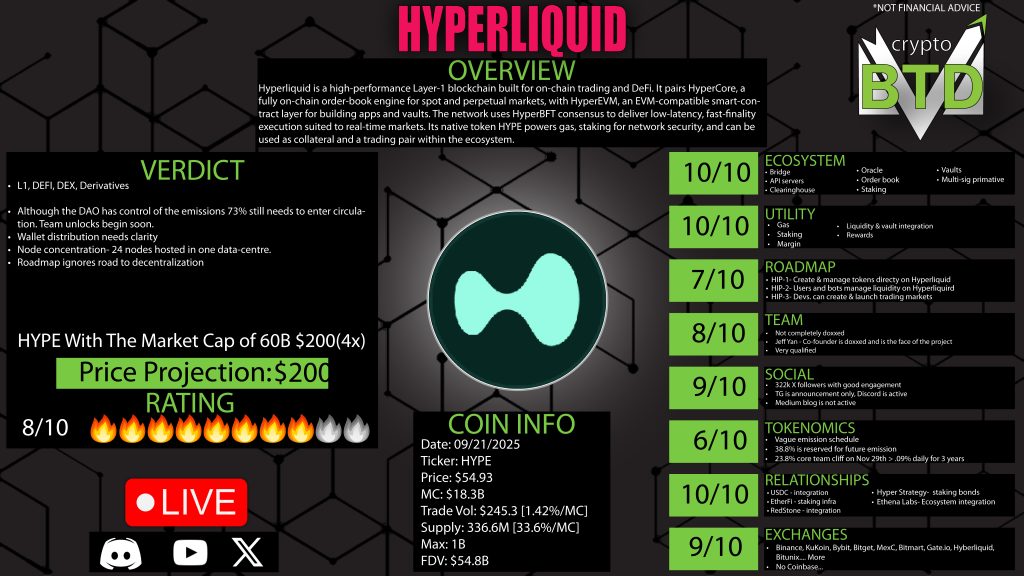

Hyperliquid is a new L1 blockchain built from the ground up to support decentralized finance (DeFi) at scale. Its bold promise? To allow users to build projects, exchange assets, and create value all on one high-performance, decentralized platform.

Where most DeFi platforms today are built on Layer 2s or older Layer 1s like Ethereum, Hyperliquid offers a fresh start. It focuses on making decentralized trading faster, cheaper, and more user-friendly, starting with its flagship application: a decentralized perpetual exchange.

Key Features That Make Hyperliquid Stand Out

- On-Chain Order Book and Settlement Layer

One of Hyperliquid’s biggest innovations is placing its order book and settlement layer fully on-chain. This is rare, especially for derivatives trading. Most other platforms keep these elements off-chain for speed, but Hyperliquid found a way to do both keep things decentralized and fast. - High Performance and Low Fees

Hyperliquid was built for speed. It uses a unique consensus mechanism called HyperBFT to deliver fast block times and smooth user experiences. Low fees and seamless trading mean fewer roadblocks for both new and experienced users. - Decentralized Perpetual Exchange

Its flagship product is a decentralized perpetual DEX (Perp DEX), meaning users can trade crypto derivatives without giving up custody of their assets. You can long or short with up to 40x leverage, all while maintaining control of your funds. - Built-In Primitives for DeFi Builders

Hyperliquid offers native DeFi building blocks, or “primitives,” for developers. These include multisig wallets, vaults, staking modules, and oracles. That means teams launching DeFi products don’t have to build from scratch – they can plug into these tools and get started faster. - EVM Compatibility

Hyperliquid is compatible with Ethereum Virtual Machine (EVM) tooling. Developers already familiar with Ethereum can deploy their smart contracts with little learning curve, boosting adoption and ecosystem growth.

Decentralization: A Work in Progress

While Hyperliquid makes bold claims about decentralization, the current infrastructure tells a more nuanced story. The validator set—a key part of blockchain decentralization—is limited to about 24 nodes. These validators are somewhat centralized, reportedly under the same umbrella organization.

However, Hyperliquid takes decentralization seriously where many others haven’t: the order book and settlement layers. These are usually centralized even on so-called decentralized exchanges. By contrast, Hyperliquid puts them fully on-chain, giving users more transparency and security.

The project appears to be taking a phased approach: prioritize performance and utility first, then decentralize the infrastructure over time. This is a common path in crypto and not necessarily a red flag.

The Hype Token: Utility and Governance

Hyperliquid’s native token is called HYPE, and it’s not just a trading asset. It has multiple functions:

- Governance: HYPE holders can vote on Hyperliquid Improvement Proposals (HIPs) and shape the future of the protocol.

- Staking: Users can stake their HYPE tokens to help secure the network and earn passive rewards.

- Vault Integration: HYPE can be used as margin or liquidity in trading vaults.

- Protocol Fees: Some network functions and features may involve HYPE, reinforcing its importance.

As more projects launch on the Hyperliquid L1, expect to see even more use cases for the HYPE token.

The DAO and Roadmap

Hyperliquid is governed by a decentralized autonomous organization (DAO), meaning token holders propose and vote on key updates. However, the roadmap is still developing. So far, proposals have focused on:

- Creating a native token standard (HIP-1)

- Launching permissionless market creation (HIP-3)

- Improving liquidity management tools (HIP-2)

One area that has yet to be addressed in detail is the decentralization of node infrastructure. This is likely to come in future proposals as the project matures.

Vaults: A Unique Product Offering

Hyperliquid introduces vaults as a native primitive. Vaults are pools of capital managed either by individual traders or algorithms. Depositors earn a share of profits, while vault managers receive a 10% performance fee. This opens the door for social trading, passive yield, and innovative DeFi strategies.

What makes vaults different here is that they are deeply integrated into the chain’s core, rather than being bolted on as a third-party contract. That offers better security, faster execution, and more flexible features.

Developer-Friendly Design

Hyperliquid’s backend, known as HyperCore, is designed to support high-performance apps. Developers can access:

- SDKs in multiple languages

- Open APIs

- Oracle services

- Multisig functionality

Plus, thanks to EVM compatibility, developers can migrate Ethereum-based projects with minimal code changes.

Partnerships and Integrations

Hyperliquid is starting to form key partnerships that boost its visibility and usage. Some highlights include:

- MetaMask (in development): Rumors suggest MetaMask may integrate Hyperliquid, allowing in-wallet trading.

- RedStone Oracles: For decentralized price feeds.

- Phantom Wallet: Already supports Hyperliquid integrations.

- Athena Labs & EtherFi: Exploring DeFi infrastructure with Hype token usage.

These relationships show that Hyperliquid is building a solid foundation for long-term growth.

Tokenomics: Supply and Distribution

Hyperliquid launched with a total supply of 1 billion HYPE tokens. As of now, around 270 million are circulating. The rest will be distributed over time:

- 38.8% to future emissions and community rewards

- 23.8% to current and future contributors (vesting starts November 2025)

- 6% to the foundation budget

- 31% already distributed at launch

While the emissions schedule is not as transparent as some investors might like, a majority of the supply is meant to go to the community. Still, better clarity around wallet distributions and vesting timelines would be a welcome improvement.

Final Thoughts: A Strong Start, With Room to Grow

Hyperliquid is an ambitious project that brings real innovation to DeFi. Its on-chain order book, focus on trading performance, and DeFi primitives make it one of the most exciting new L1s to watch.

While the node centralization issue and limited team transparency are valid concerns, they do not cancel out the groundbreaking features Hyperliquid already offers. As more developers build on it and governance matures, there’s a good chance Hyperliquid will continue to lead the next generation of decentralized finance.

Whether you’re a developer, DeFi user, or just a crypto enthusiast, Hyperliquid is worth keeping on your radar.

0 Comments