In the ever-expanding world of crypto, there’s always a new project trying to revolutionize how we interact with money, assets, and technology. One of the more intriguing and complex contenders is Keeta Network – a high-performance layer-one (L1) blockchain built to connect all payment networks and assets across chains. But is it over-engineered, or is it simply misunderstood?

This deep dive breaks Keeta down into digestible pieces. We’ll explore its fundamentals, tech stack, compliance strategy, and potential, all from a retail investor’s perspective.

What is Keeta Network?

Keeta isn’t just another blockchain — it’s an ambitious infrastructure project aiming to reshape how global payments and asset transfers operate. At its core, Keeta is designed for the future of finance: programmable money, real-world asset (RWA) tokenization, and digital identity verification, all bundled into a high-speed and compliant platform.

The project’s focus on institutional readiness is particularly noteworthy. Banks, governments, and major enterprises increasingly look for blockchains that meet regulatory requirements. Keeta embraces this head-on by building KYC/AML support directly into its protocol. This positions Keeta uniquely as a bridge between traditional finance and decentralized systems.

Keeta Network aims to become the backbone of global payment infrastructure. Its slogan is “Where networks connect,” and that vision drives everything about the project. From cross-chain compatibility to built-in compliance, Keeta is tackling some of the most important narratives in crypto today:

- Cross-chain transactions

- Real-world asset tokenization (RWA)

- Regulatory compliance (KYC/AML)

- High-speed, scalable architecture

Key Features of Keeta

1. Cross-Chain Compatibility

Keeta enables seamless transactions across different blockchain networks, acting as a unifying layer. In a world where liquidity is often trapped in silos, Keeta opens the doors to smoother asset flow.

2. Real-World Asset Tokenization

Real-world assets (RWAs) are heating up in the crypto space, and Keeta is building an ecosystem that makes it easy to tokenize and trade them.

3. Compliance-Focused Architecture

Unlike many crypto projects that operate in the gray area, Keeta embraces regulation. With built-in KYC, digital identity verification, and regulatory compliance, it appeals to institutions and traditional finance.

4. Speed & Scalability

Keeta boasts 10 million transactions per second (TPS) with a 400-millisecond settlement time. These claims are supported by industry heavyweight Eric Schmidt, former CEO of Google, who is also an investor.

Architecture: Not Your Average Blockchain

Keeta doesn’t use a traditional blockchain. Instead, it utilizes a Directed Acyclic Graph (DAG) structure, which allows for parallel processing of transactions. This means:

- More transactions per second

- Lower latency

- Less bottlenecking

Keeta’s consensus mechanism is a Delegated Proof-of-Stake Voting Protocol, enabling fast and secure validation with multiple voting phases.

Built-In Compliance and Identity Verification

Keeta’s standout feature is its direct alignment with the needs of institutions. With growing regulatory scrutiny in crypto, having KYC and identity layers built into the infrastructure offers real advantages. Rather than retrofitting compliance, Keeta bakes it in from day one.

This enables use cases like:

- Blockchain-based credit scoring and on-chain financial history

- Tokenized real estate or equities that comply with global securities laws

- Government-approved identity frameworks for digital ID management

These use cases go far beyond speculation and meme coins. They point toward real-world integration, where blockchain isn’t just an alternative to traditional finance – it’s an upgrade.

Keeta stands out for baking compliance directly into its protocol:

- Digital ID verification

- KYC / KYB integration

- Certificate-based access control

This approach makes it easier for institutions to interact with Keeta while reducing the risk of regulatory clampdowns. However, it also raises privacy concerns for crypto purists.

Complexity: A Double-Edged Sword

One major challenge with Keeta is its complexity. While the tech is robust, it can be overwhelming for retail investors. From multiple types of accounts (e.g., key accounts, token accounts, operator accounts) to intricate permission systems and rule engines, it can feel more like studying for a computer science exam than researching a crypto project.

The documentation is deep but dense, spread across:

- Whitepapers

- Product manuals

- Gitbooks

Team Overview

Keeta has a small, young team with engineering talent and startup energy. Notable members include:

- CEO: Tech background, but limited public experience in crypto.

- CTO: Strong engineering background, AWS experience.

- Software Engineers: Some with long tenure at Keeta and relevant technical expertise.

While the team is fully doxxed, transparency on roles, experience, and credentials could be improved.

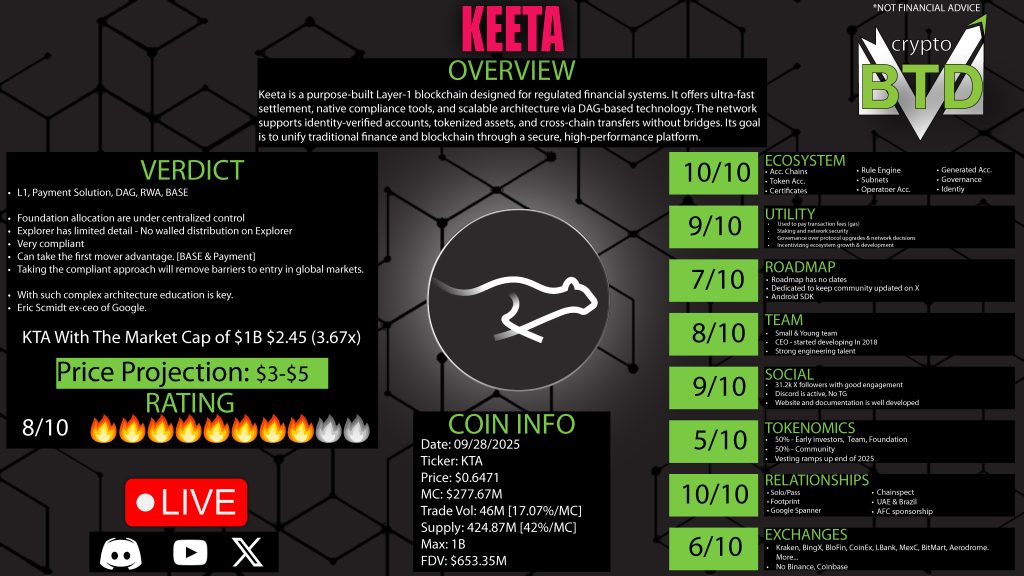

Tokenomics: A Mixed Bag

Keeta’s ($KTA) token distribution is as follows:

- 40% Strategic Reserve (includes early investors and team)

- 10% Foundation

- 50% Community & Ecosystem Growth

Concerns:

- Early investors and team control 40%, which is significant.

- Lack of clarity on how tokens are unlocked or distributed.

- No clear governance role for token holders over treasury funds.

Vesting ramps up in late 2025, which could lead to heavy dilution during a potential bear market.

Community & Social Presence

For Keeta to thrive, developer and community engagement must grow. While the existing Gitbook and whitepapers are technically detailed, onboarding could be much smoother. SDKs in multiple languages, educational content, and simple walkthroughs for building dApps on Keeta would go a long way.

Community-driven development often leads to innovation. Ethereum’s success was driven in part by its vibrant developer base. Keeta has the potential to replicate that if it invests in hackathons, grants, and better documentation for newcomers.

Keeta is still in its early stages of community development:

- ~31,000 Twitter followers

- Active Discord

- No Telegram

- Minimal GitHub activity visible to the public

Explorer & Roadmap

Keeta’s current blockchain explorer is underwhelming, lacking transparency in wallet distributions and other critical data.

Its roadmap lacks clear timelines, though it includes exciting goals like SDK development for Android and iOS.

Partnerships & Ecosystem

Despite its size, Keeta has landed some impressive partnerships:

- Google Cloud: Hosting nodes (raises questions about centralization)

- Agora: Financial services convergence

- Footprint: KYC provider

- Solo: On-chain credit bureau

- UAE & Brazil expansion

- AFC sponsorship

These partnerships show Keeta is serious about compliance and mainstream adoption.

Final Verdict: Is Keeta Worth Your Attention?

Keeta is not for everyone. Its focus on compliance and regulation-first infrastructure won’t appeal to decentralization purists. But for investors and developers looking at the long game, where institutions and blockchains finally converge, Keeta is a serious contender.

Its architecture supports high-throughput applications. Its compliance layer addresses real regulatory hurdles. And its potential to host things like CBDCs, national digital ID systems, or tokenized capital markets cannot be ignored.

If Keeta can simplify its onboarding and communication strategy, it could emerge as a foundational layer in the next era of crypto.

Keeta is one of the most complex blockchain projects out there, offering:

- Deep compliance capabilities

- An advanced and scalable DAG structure

- A strong value proposition for institutions

However, it comes with trade-offs:

- High centralization

- Steep learning curve

- Unclear token governance

- No major exchange listings yet (e.g., Binance, Coinbase)

If Keeta can simplify its user experience and stay committed to transparency, it could become a serious contender in the L1 space, especially as compliance narratives gain traction.

Our Score: 8/10

Your Turn: What do you think about Keeta Network? Is this the future of compliant blockchain, or is it too centralized to fit the crypto ethos?

Let’s discuss in the comments!

0 Comments