Table of Contents

The blockchain space is constantly evolving, driven by innovation, developer creativity, and community enthusiasm. New projects promise to solve problems of scalability, security, and interoperability. One of the latest players to enter the arena is Movement, a hybrid Layer 1 (L1) and Layer 2 (L2) blockchain ecosystem. It uses a unique virtual machine architecture and custom programming language with ambitions of powering the next generation of decentralized applications.

But while Movement’s technological promises are ambitious, recent events have triggered serious concerns. A market-making scandal, team leadership issues, and questionable token distribution have placed Movement under intense scrutiny.

This deep dive aims to objectively examine the Movement blockchain from a retail investor perspective. We’ll look at the tech, team, tokenomics, community, controversy, and overall investment outlook.

What is the Movement Blockchain?

Movement is a blockchain protocol that operates as both:

- A Layer 2 on Ethereum (currently live), and

- A soon-to-launch Layer 1 with its own Move Virtual Machine (MoveVM).

It’s built around the Move programming language, initially created by Facebook’s Diem project. Movement’s long-term goal is to deliver a modular, scalable, and secure blockchain ecosystem that supports both EVM-based and Move-based applications.

Key value propositions:

- High transaction throughput (TPS)

- Modular architecture for flexibility

- Cross-chain interoperability

- Safe smart contract execution via MoveVM

- Multi-asset staking and governance (planned)

With Ethereum compatibility and its own independent chain in development, Movement positions itself as an adaptable solution for developers and users alike.

Movement Blockchain’s Tech Stack: Dual Virtual Machines and Modular Design

Movement’s architecture is technically impressive. It integrates both the Ethereum Virtual Machine (EVM) and the Move Virtual Machine (MoveVM). This gives it the flexibility to:

- Support existing Ethereum dApps and tooling

- Offer new security features and programming paradigms through Move

Key components include:

- MoveVM: Designed to prevent bugs and exploits through a safer programming model. Assets are treated as “resources” that can’t be duplicated or accidentally lost.

- Fast Finality Settlement (FFS): A consensus layer that reduces latency and enables near-instant transaction confirmation.

- Shared Sequencer: Distributes the ordering of transactions across multiple nodes, reducing centralization risks.

- Modular Execution Environment: Enables upgradeable chains and application-specific customizations.

- Multi-VM Interoperability: Allows contracts and tokens to move between MoveVM and EVM.

The aim is to become a highly scalable base-layer infrastructure that combines the safety of Move with the adoption of Ethereum.

Movement and the Move Programming Language: A Security-Focused Alternative

Move is a smart contract language developed by Facebook engineers. It focuses on asset safety and prevents some of the vulnerabilities seen in Solidity (e.g., reentrancy attacks).

Pros of Move:

- Ownership is a first-class concept

- Resources (tokens) can’t be copied or accidentally deleted

- Clearer security guarantees than Solidity

Cons:

- Smaller developer pool

- Less tooling and ecosystem support compared to Solidity

- Steeper learning curve for newcomers

Still, Move has become more popular thanks to projects like Sui and Aptos. Movement is banking on this trend continuing as developers seek safer alternatives.

Movement Mainnet Status and Ecosystem

As of now, Movement’s L1 mainnet is not yet live. It operates as an L2 on Ethereum, using an ERC-20 version of the MOVE token. Developers can build dApps today, but native MoveVM applications and interoperability with the custom L1 chain will only be possible after the mainnet launch.

Despite this, Movement already has an emerging ecosystem:

- 160+ early-stage projects

- Wallet integrations (e.g., BitWallet)

- DeFi protocols (e.g., Avidis for lending/borrowing)

- NFT and gaming experiments (e.g., Gorilla Movement)

While these projects are mostly small, they show strong developer interest. The dual-VM setup makes it easy to port over existing Solidity dApps, providing an on-ramp for ecosystem growth.

Movement Tokenomics and Distribution: Transparency Issues

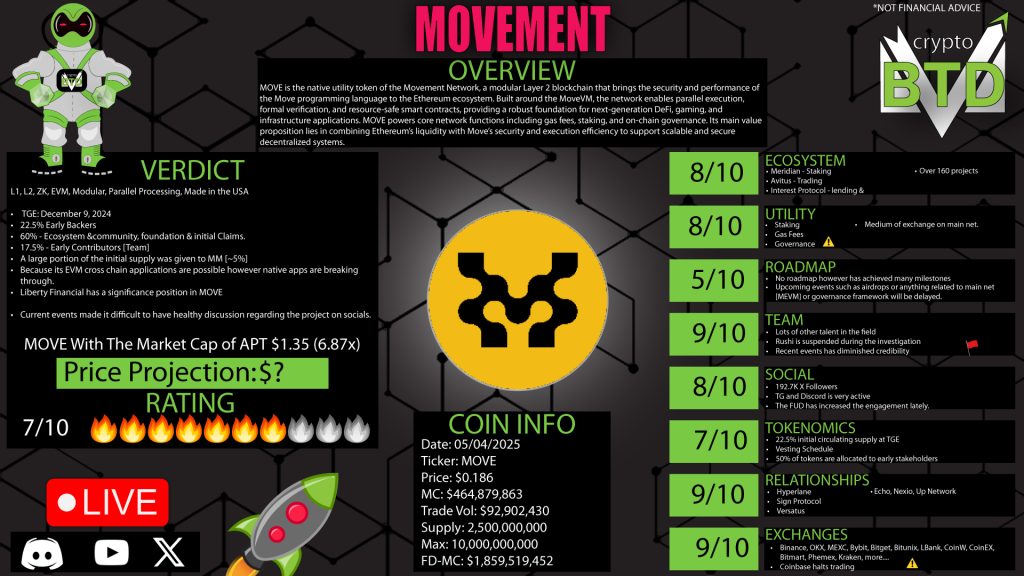

The MOVE token was launched on December 9, 2024, with a maximum supply of 10 billion tokens.

Token allocations:

- Community & Ecosystem: 60%

- Foundation: 10%

- Team & Contributors: 17.5%

- Early Backers: 22.5%

- Initial Claims & Airdrops: 10%

Concerns:

- 22.5% of tokens were in circulation at TGE, but it’s unclear exactly who received them.

- Many believe early backers received immediate liquidity, allowing for significant sell pressure.

- One wallet linked to a market maker was seen dumping large volumes of MOVE shortly after launch.

This kind of early distribution — without clarity or governance — can shake investor confidence. Movement claims 60% of tokens go to the community, but without a DAO or voting system, this claim lacks accountability.

Movement Market Maker Scandal: What Happened?

In April 2025, Movement Labs suspended co-founder Rushi Manche after news surfaced that a market maker had dumped 66 million MOVE tokens, profiting $38 million. This caused MOVE’s price to crash and triggered widespread community backlash.

- Coinbase announced it would suspend MOVE trading starting May 15, 2025.

- Binance had previously blacklisted wallets involved in suspicious trades.

- The dumping is believed to be linked to a contract signed by Movement Labs with Redtech, a shadowy market-making entity.

Redtech allegedly held 5% of the supply and was incentivized to inflate token price to a $5B valuation, then dump. The signed contract reportedly split profits between Redtech and Movement Labs.

This raises serious ethical and legal questions:

- Who approved this deal?

- Did the broader team know?

- How will the community be compensated?

Movement Labs has stated that an independent third-party audit is underway.

Movement DAO and Governance: Still Missing

Despite planning to become a decentralized protocol, Movement has no active DAO. There is:

- No way for token holders to vote on proposals

- No community treasury in action

- No governance structure to prevent centralized decisions

This makes Movement functionally centralized, especially concerning given that over 70% of tokens are held by a foundation wallet.

Without a DAO, there’s no accountability or transparency on token distribution, market-making deals, or team decisions.

Movement Team: Strong Talent, Weak Oversight

Movement Labs boasts an impressive team of:

- Software engineers

- PhDs in blockchain

- Former Sui, Coinbase, and Uber employees

Key Members:

- Rushi Manche (Suspended Co-founder): Software engineer and founder, allegedly involved in Redtech contract

- Cooper Scanlan (Co-founder): Little public information available

- Brian Age: Former Head of Ecosystem at Sui, strong track record

- Head of Research: Academic with credible credentials and Web3 experience

The team clearly has talent, but the lack of transparency and accountability among leadership raises serious concerns.

Movement Roadmap: Too Vague

Movement’s roadmap outlines big milestones:

- Mainnet launch

- Move stack completion

- Shared sequencer deployment

- Interoperability upgrades

But it lacks:

- Timelines

- Milestone tracking

- Versioning

- Progress reports

Given the current controversy, investors are asking: What’s the plan from here?

Movement Social Media and Community

Movement has a strong online presence:

- 200,000+ X (Twitter) followers

- Active Discord & Telegram

- GitBook-style documentation

However, recent FUD has overwhelmed real conversation. Discord is filled with:

- Frustrated investors demanding refunds

- Defenders pumping positivity

- Unanswered questions about governance

The loss of trust is clear.

Final Verdict on Movement: Risky But Redeemable?

Movement is a classic example of a project with:

✅ Strong tech foundation — Movement’s hybrid architecture featuring both the Move Virtual Machine and Ethereum Virtual Machine allows for flexible, secure, and scalable blockchain development. It aims to provide fast finality, modular execution, and broad interoperability, setting a high bar for infrastructure innovation.

✅ Ambitious vision — The project seeks to become a foundational Layer 1 and Layer 2 blockchain platform that supports secure smart contracts, multi-chain applications, and developer-first tooling. This vision aligns with solving some of the crypto industry’s most pressing challenges.

✅ Talented engineers — The team includes former leaders and engineers from major players like Sui, Coinbase, and Uber. Their combined experience spans cryptography, blockchain development, and decentralized systems.

❌ Poor governance — Despite its stated decentralization goals, Movement currently lacks an active DAO or community-driven proposal system. This centralization undermines its credibility and raises questions about decision-making transparency.

❌ Questionable token distribution — The initial 22.5% token release at TGE remains unexplained. There’s growing suspicion that early investors and market makers were given favorable access, leading to outsized sell pressure and a loss of confidence.

❌ Damaged trust from scandal — The market maker dump scandal, combined with vague accountability around signed contracts, has significantly eroded retail trust. Even with an independent audit underway, the reputational damage may take time — and action — to repair.

Movement earns strong marks for its technical design (9/10) and team depth (9/10), supported by a healthy early ecosystem (8/10) and community engagement (8/10). However, serious concerns emerge in transparency (4/10), vague roadmap execution (4/10), and the absence of governance (3/10). Tokenomics are moderately acceptable (7/10), but early distribution issues raise red flags. Taking all this into account, the overall rating for Movement is 7 out of 10 — a project with great potential but significant risks until governance and transparency improve.

The future depends on:

- Results of the third-party audit

- Launch of the L1 mainnet

- Implementation of DAO governance

- Community support and trust rebuilding

If these critical issues — governance, transparency, and trust — are addressed, Movement has a real chance to stage a remarkable comeback. The project has already laid the groundwork with a strong technical base, an enthusiastic developer community, and a growing early ecosystem. Should the team implement a transparent DAO structure, launch the L1 mainnet successfully, and clarify token allocation, Movement could transition from high-risk to high-reward.

For long-term investors willing to monitor closely and remain patient, Movement may eventually emerge not just as a cautionary tale — but as a case study in recovery, reform, and resilience. The coming months will be critical in proving whether this project can rebuild trust and solidify its place in the future of blockchain infrastructure.

Can Movement overcome its recent setbacks and fulfill its vision for the future of blockchain? Let us know what you think in the comments below.

0 Comments