Table of Contents

Introduction

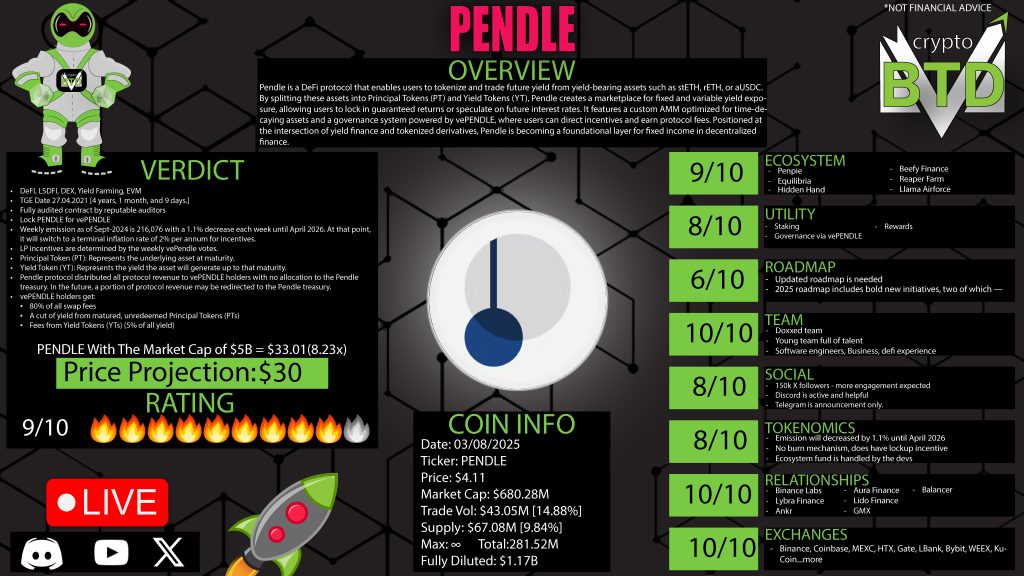

DeFi (decentralized finance) is changing the game, and Pendle is one of the boldest players rewriting the rules. Imagine earning passive income while retaining full control of your assets, or even trading future yield like it’s a commodity. That’s the power of Pendle. In this deep dive, we’ll unpack what makes Pendle so compelling—from its cutting-edge mechanics to its team, tokenomics, and future roadmap.

What Is Pendle?

Pendle is a next-generation DeFi protocol designed to tokenize and trade future yield from yield-bearing assets. It gives users powerful tools to maximize their returns while maintaining liquidity and flexibility. This means you don’t have to choose between earning yield and accessing your funds—you can do both.

What sets Pendle apart is its ability to take any asset that earns yield (like stETH or USDe) and split it into two separate tokens:

- Principal Token (PT): Represents the underlying asset and matures into the full value.

- Yield Token (YT): Represents the right to earn the yield over a fixed period.

This division creates new opportunities for users to invest, speculate, or hedge their positions.

Key Features

1. Yield Tokenization

Yield tokenization is the foundation of Pendle’s unique offering. It lets users isolate and separately trade the yield and the principal from any yield-bearing asset. This unlocks a wide range of strategies:

- Earn fixed income by buying PT at a discount.

- Speculate on yield increases with YT.

- Hedge yield exposure depending on market conditions.

This capability gives users a financial edge in unpredictable markets and makes Pendle ideal for both conservative and aggressive strategies.

2. No Lock-Up Periods

Liquidity is a major concern in DeFi. Pendle addresses this by allowing users to exit their positions at any time. PT and YT tokens can be traded on Pendle’s AMM, making the ecosystem fully liquid. Unlike traditional staking where your assets are frozen for weeks or months, Pendle users have the freedom to move their funds when needed.

This liquidity boosts confidence, especially during market volatility, and lowers the barrier to entry for new users.

3. Cross-Chain Compatibility

Pendle is already live on Ethereum, Arbitrum, BNB Chain, and Optimism. These are all EVM-compatible chains, making it easy to onboard assets and users. This multi-chain design ensures Pendle can scale with the broader DeFi ecosystem and take advantage of lower gas fees and different liquidity markets.

Future plans may include integrating with non-EVM chains like Solana or Cosmos, increasing access and further decentralizing yield opportunities.

4. Gamified Yield Farming

Pendle turns yield farming into a strategy game. Instead of just staking and forgetting, you can actively manage your assets across different pools and optimize returns. With real-time APY data and strategic insights, users can rotate into better-performing assets and increase their yield over time.

It’s more than just passive income—it’s a dynamic yield-earning experience.

The vePENDLE Mechanism

Pendle introduces a powerful governance model with vePENDLE. When you stake PENDLE tokens, you receive vePENDLE in return. This governance token plays a key role in the ecosystem.

Benefits of holding vePENDLE:

- Vote on liquidity emissions and pool incentives.

- Earn a portion of protocol fees (100% of fees currently go to vePENDLE holders).

- Boost your liquidity provider rewards.

This mechanism ensures that long-term holders are rewarded and that governance decisions align with community interests. It adds sustainability and community ownership to the platform.

Security First

Pendle takes smart contract safety seriously. It has been audited by at least eight independent firms, including some of the biggest names in blockchain security. Each audit covers different modules and functionalities to ensure robustness.

With growing hacks and exploits in DeFi, Pendle’s emphasis on security gives users peace of mind. Whether you’re staking stablecoins or trading YT tokens, you can trust the contracts that support the system.

Tokenomics Overview

Pendle’s tokenomics are designed to support long-term growth and ecosystem incentives. Here’s a breakdown:

- Total Supply: Inflationary with a controlled emission schedule. Max 2% annual inflation rate post-2026.

- Circulating Supply: Over 60% already circulating, reducing risk of major unlock events.

- Emission Schedule: Weekly emissions decreasing by 1.1% until April 2026, then stabilizing.

The emissions support liquidity mining, community incentives, and ecosystem expansion. Meanwhile, all team and investor tokens fully vested as of September 2024, aligning incentives across the board.

Governance and Ecosystem

Pendle’s governance is community-led via vePENDLE, which lets users shape emissions and yield strategies. This decentralized approach puts power in the hands of those who contribute most to the platform.

Beyond governance, Pendle is building a thriving ecosystem. Tools and integrations with projects like Beefly Finance, Hidden Hand, and others help broaden use cases and liquidity sources. This layered design helps Pendle stay ahead in a crowded DeFi market.

Educational Resources

Pendle goes above and beyond in educating users. Their documentation is detailed yet beginner-friendly, with video explainers, blog posts, and interactive guides. These materials break down complicated concepts like:

- Yield tokenization

- How PT and YT work

- How to earn with vePENDLE

By lowering the knowledge barrier, Pendle empowers everyday users to take control of their DeFi journey.

Team Transparency

The Pendle team is young, dynamic, and deeply experienced in DeFi and software development. Key members include:

- NTL (CEO): Public-facing, active in the community, previously part of Kyber Network.

- Long Vong: Head of Engineering, formerly at Jump Trading, with strong CS credentials.

The team is doxxed, and several members have backgrounds from top universities and crypto projects. Their focus on openness builds trust and sets a strong foundation for long-term growth.

Room for Growth

Pendle is already strong, but there’s room for improvement:

- More frequent posts on Medium to share roadmap progress and product updates.

- Clickable partner logos that explain each partnership’s role.

- A quarterly roadmap to help the community track milestones.

Improving communication can further enhance trust and engagement.

Roadmap: What’s Next?

Pendle’s roadmap for 2025 and beyond includes two major pillars:

- Citadels: A new system for structured yield products, offering more advanced strategies for power users and institutional players.

- Borrows: A borrowing feature using PT as collateral, unlocking liquidity without selling the underlying principal.

These initiatives aim to transform Pendle into a full-service DeFi hub, enabling complex yield and lending strategies all within a single platform.

Final Verdict: 9/10

Here’s how Pendle ranks across key areas:

- Innovation: Yield tokenization is a game-changer.

- Utility: Real use cases and strong ecosystem tools.

- Tokenomics: Solid structure, but lacks a burn mechanism.

- Security: Multiple high-quality audits.

- Governance: vePENDLE system is strong but can grow.

- Community: Needs stronger engagement on social platforms.

- Transparency: Blog and roadmap need more consistent updates.

Overall, Pendle is one of the most promising DeFi protocols out there. It delivers real value to users and has a clear path to scaling. With solid security, an innovative model, and a passionate team, Pendle is well-positioned to lead the next wave of DeFi adoption.

Want more DeFi breakdowns like this? Follow and share!

0 Comments