Table of Contents

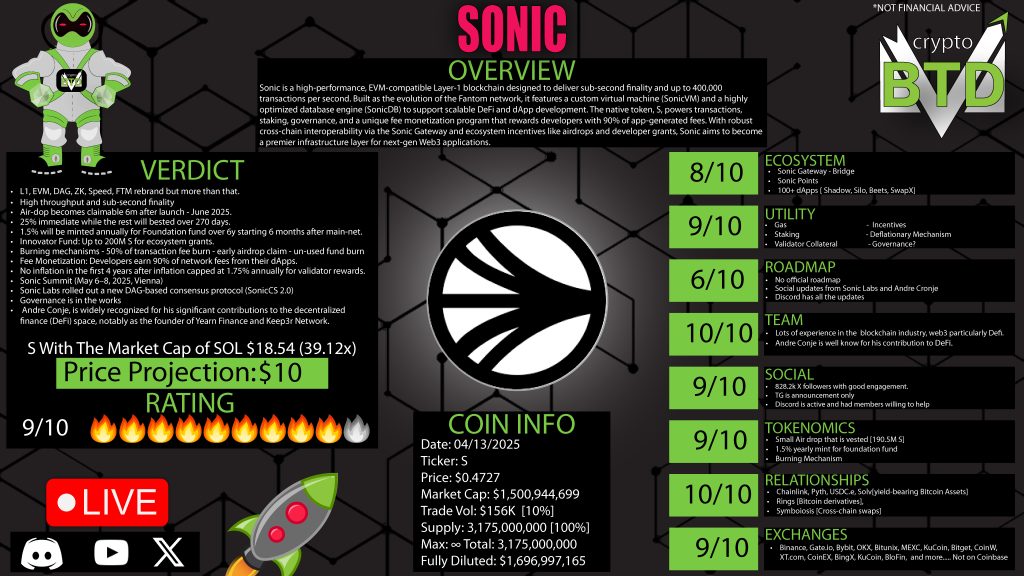

The world of blockchain continues to evolve, and in 2025, one name is making major waves: Sonic. Touted as the fastest EVM-compatible Layer 1 (L1) blockchain, Sonic is more than just a high-speed network. It combines next-gen infrastructure, user incentives, developer monetization, and smart tokenomics. Whether you’re a crypto enthusiast, a developer, or an investor, Sonic deserves your attention.

In this deep dive, we break down Sonic from a retail perspective — focusing on the core fundamentals like the team, tokenomics, utility, ecosystem, and growth potential. By the end, you’ll have a clear picture of whether Sonic belongs in your crypto portfolio.

What Is Sonic?

Sonic is an upgraded and reimagined blockchain that originated from the Fantom network. But make no mistake — this isn’t just a rebrand. Sonic introduces a new chain with its own coin, Sonic S, along with revamped infrastructure and blistering speed capabilities.

The key highlights include:

- Over 400,000 transactions per second (TPS)

- Sub-second finality

- Full EVM compatibility

- Developer-focused monetization (up to 90% of app fees)

- Robust DeFi and dApp support

Sonic aims to be the go-to chain for high-speed applications, especially those in the DeFi and gaming sectors.

Sonic vs. Fantom: What’s the Deal?

Sonic emerged as an evolution of Fantom, carrying over its liquidity and ecosystem while introducing major upgrades. Users can bridge their $FTM tokens to Sonic S through a one-way bridge, allowing them to migrate their assets seamlessly. However, you can’t go back from Sonic to Fantom — making the move one-directional for now.

Why make the move? Sonic offers superior speed, enhanced infrastructure, lower fees, and a more developer-friendly environment. With better tools, faster confirmation, and higher scalability, Sonic is designed to fix many of Fantom’s limitations while building on its strengths.

Why Sonic Stands Out

- Speed: Sonic boasts 400K TPS with near-instant transaction finality, making it ideal for real-time DeFi, gaming, and metaverse apps.

- EVM Compatibility: Developers can build using Solidity and Vyper without friction. Migrating from Ethereum or other EVM chains is seamless.

- Developer Monetization: Builders earn up to 90% of transaction fees from their dApps, offering a sustainable revenue model.

- Active Ecosystem: Projects like SpookySwap, Curve, SushiSwap, and newer native apps are already active.

- User & Developer Tools: Sonic supports multiple wallets (Rabby, MetaMask, OKX, Trust Wallet), staking options, and bridges.

- Airdrop Incentives: Users earn points and rewards through on-chain activities, leading to generous airdrop eligibility.

The Sonic Ecosystem: Small But Mighty

Sonic is still early in its growth, but the foundations are solid. The ecosystem already includes:

- DeFi protocols: SpookySwap, Kyber, Curve, Beefy Finance, SushiSwap

- NFT platforms: PaintSwap, Shadow Exchange

- Infrastructure: Chainlink, Pyth, Symbiosis, Safe

- Wallets: Rabby Wallet, MetaMask, Trust Wallet

- Bridges: Sonic Gateway (Ethereum and Fantom compatible)

New apps and services are being added regularly, driven by strong incentives for builders. Sonic also supports traditional EVM projects, giving it a fast-track to ecosystem growth.

S Tokenomics: Breaking It Down

Sonic’s token ($S) has a total supply of 3.175 billion tokens, with a flexible supply model similar to Ethereum. Here’s how it’s structured:

- Initial Supply: 3.175 billion $S tokens

- 6% Airdrop Program: Rewarding early adopters and users

- 1.5% Annual Minting: For development and operations (over 6 years)

Burning Mechanisms:

- 50% of fees from non-participating apps are burned

- Airdrop tokens claimed early are partially burned

- Unused development funds are burned annually

These mechanisms ensure deflationary pressure on the token, helping maintain long-term value despite a flexible supply.

Staking & Earning on Sonic

Users can stake their $S tokens to support network security and earn a steady return. The current APR is around 5%, making it attractive for passive income seekers.

Validators and delegators play a crucial role in the network’s health and decentralization, and staking contributes to overall network security while offering user rewards.

Governance and Decentralization

Governance features are not live yet but are part of the roadmap. Once launched, Sonic aims to transition into a DAO structure where $S holders can vote on key protocol decisions. This will include:

- Funding proposals

- Protocol upgrades

- Ecosystem grants

Until then, Sonic is guided by the experienced Fantom Foundation team. Transparency is maintained through regular updates, newsletters, and social media engagement.

Upcoming Airdrop & Points Program

Sonic’s airdrop is a hot topic in the crypto community. Here’s what to expect:

- Launch Date: June 2025

- Claiming Structure: 25% unlocked at launch; 75% vested over 270 days

- Burn Incentive: Early claiming leads to partial burns, discouraging quick sell-offs

Users can earn points by:

- Transacting on the network

- Using dApps

- Holding $S

- Engaging with verified partners (like Beefy Finance)

This creates a healthy loop of engagement, usage, and reward.

The Sonic Summit 2025: What to Expect

Scheduled for May 6–8 in Vienna, the Sonic Summit is expected to drive major announcements:

- A native DEX with perpetuals and leverage

- A new algorithmic stablecoin unique to Sonic

- Expansion of developer grants and new partnerships

This could become a major turning point for Sonic, similar to how other blockchain summits have propelled platforms like Solana and Avalanche.

The Sonic Team

Sonic is led by DeFi pioneer Andre Cronje, known for founding Yearn Finance and contributing to Ethereum DeFi tooling.

Other notable team members include:

- Michael Kong — CEO, previously CTO of Fantom

- Harry Yeh — Executive Chairman and crypto strategist

- Additional engineers, product leads, and community managers from Fantom and other blockchain projects

Their combined experience in DeFi, smart contract development, and blockchain architecture gives Sonic a serious competitive edge.

Exchanges & Accessibility

$S is available on most major centralized and decentralized exchanges:

- Binance

- KuCoin

- Bybit

- Gate.io

One major exchange missing is Coinbase, but its inclusion is likely as Sonic gains traction.

Pros and Cons of Sonic

Pros:

✅ Lightning-fast transactions (400K TPS, sub-second finality)

✅ Strong development team led by Andre Cronje

✅ EVM-compatible (Solidity & Vyper support)

✅ Attractive rewards for developers and users

✅ Over 100 dApps already live and growing

✅ Robust burn mechanisms to reduce inflation

✅ Transparent communication via socials and newsletters

✅ Incentivized ecosystem with builder grants and user rewards

Cons:

Governance features still under development

❌ No official roadmap publicly available

❌ Not listed on Coinbase yet

❌ One-way bridge from Fantom (can’t bridge back)

❌ New ecosystem with early-stage risks and growing pains

Final Thoughts

Sonic is shaping up to be one of the most exciting Layer 1 blockchain projects of 2025. With lightning-fast speeds, serious backing from experienced developers, and an expanding dApp ecosystem, Sonic is pushing boundaries on what an EVM-compatible chain can deliver.

The upcoming airdrop, Sonic Summit, and potential native DeFi tools make this a high-opportunity, moderate-risk project for early adopters.

Whether you’re a developer looking to monetize your dApp or a crypto user searching for high-performance chains, Sonic has something to offer.

Are you ready to move at Sonic speed?

0 Comments